Key Focus This Week “Core PCE, GDP and Walmart Earnings to Test Market Conviction in Holiday-Shortened Week”

With U.S. markets closed Monday for Presidents’ Day, trading volumes are expected to remain lighter at the start of the week before accelerating into a series of high-impact economic releases. Following last week’s combination of resilient labor data and moderating CPI, markets now turn to confirmation signals on both inflation and growth momentum.

The primary focus will be Friday’s release of the Core Personal Consumption Expenditures (PCE) Index — the Federal Reserve’s preferred inflation measure. After January CPI showed further easing in price pressures, investors will assess whether PCE data confirms that disinflation remains on track. Any upside surprise could challenge current rate-cut expectations, while continued moderation would reinforce the view that policy easing later this year remains viable.

Growth dynamics will also come under scrutiny. The advance estimate of fourth-quarter U.S. GDP, alongside personal income and spending data, will provide insight into consumer resilience entering 2026. Recent labor market strength suggests underlying economic stability, but markets will look for confirmation that consumption and output remain durable without reaccelerating inflation pressures.

Housing and trade data scheduled earlier in the week will add further clarity to domestic demand and external balance conditions, particularly as higher rates continue to influence interest-sensitive sectors.

On the corporate front, Walmart’s earnings report will serve as a key barometer of consumer behavior. As one of the largest U.S. retailers, its results and forward guidance may offer important signals regarding discretionary spending, pricing power, and margin sustainability. In a market environment increasingly sensitive to forward guidance, earnings commentary may have outsized influence on sector positioning.

Last Week’s Key Economic Data & News Recap

U.S. January Jobs Report Surprises to the Upside, Tempering Immediate Rate-Cut Expectations

The delayed January employment report showed that the U.S. economy added 130,000 nonfarm payrolls, exceeding market expectations of roughly 55,000–70,000. The unemployment rate declined to 4.3%, down from 4.4% in the prior month. While the headline figure reflects continued labor market resilience, the broader trend remains one of moderating employment growth following substantial downward revisions to prior months.

The stronger-than-expected payroll data reduced expectations for an immediate Federal Reserve rate cut. Interest rate futures pricing shifted following the release, with market-implied probabilities for near-term easing declining as investors reassessed the timing of potential policy adjustments. The data reinforced the view that policymakers can remain patient while monitoring both inflation and labor market dynamics.

Inflation Continues to Moderate as January CPI Slows Further

Inflation data released at the end of the week showed further easing in price pressures. The Consumer Price Index rose 2.4% year-over-year in January, down from 2.7% in December, marking the lowest annual pace since May. Core CPI, which excludes food and energy, increased 2.5% year-over-year, down from 2.6% previously and the lowest reading since early 2021.

On a monthly basis, headline CPI increased modestly, reflecting stable energy prices and slower goods inflation. The combination of moderating inflation and a still-stable labor market supports a “higher-for-longer but not tightening” narrative for monetary policy. While markets continue to anticipate rate cuts later in the year, the January data did not materially accelerate expectations for immediate easing.

Equity Markets Experience Volatility Despite Constructive Macro Data

Despite encouraging macroeconomic data, U.S. equities experienced elevated volatility throughout the week. Major indexes moved between gains and losses as investors weighed the implications of resilient labor data, moderating inflation, and earnings results.

Mid-week selling pressure intensified in large-cap technology names, contributing to sharp intraday swings. On Thursday, the Dow Jones Industrial Average fell more than 600 points as risk sentiment deteriorated following earnings reactions and positioning ahead of CPI. By Friday, inflation data helped stabilize sentiment, though weekly performance reflected the market’s sensitivity to both policy expectations and corporate guidance.

Key Earnings Highlight Divergence Across Sectors

Corporate earnings were a major driver of sector rotation during the week. In consumer discretionary, McDonald’s reported quarterly results that exceeded expectations, with global comparable sales increasing 5.7% and U.S. comparable sales rising 6.8%, supported by value-focused promotions and resilient consumer demand.

In contrast, Ford reported a quarterly net loss of approximately $11.1 billion, largely reflecting write-downs and restructuring charges, though revenue came in at $45.9 billion, slightly above estimates. The company issued full-year EBIT guidance of $8–$10 billion, highlighting ongoing margin pressure in electric vehicle operations.

Within consumer staples, Coca-Cola’s quarterly revenue came in slightly below expectations, and the company guided to 4%–5% organic revenue growth for 2026, a pace viewed as moderate relative to prior years.

In technology, margin concerns resurfaced as companies cited higher component and input costs. Several large-cap names experienced significant post-earnings price swings, reinforcing investor sensitivity to profit margins and forward guidance amid elevated valuations.

Investing with an AimStar's investment professional

Want expert advice at every step of your investing journey?

AimStar’s investment professionals can set you on the right course – and they can meet in-person or online.

Market Performance Review – Last Week

Source: Yahoo Finance

Canadian Equities:

Canadian equities closed higher for the week, supported by gains in materials and energy names. The S&P/TSX Composite Index ended Friday at 33,073.71, advancing on the final trading session and stabilizing after early-week volatility. Strength in precious metals prices provided support to mining shares, while energy stocks tracked fluctuations in crude oil prices. The index remained sensitive to U.S. macroeconomic releases, particularly inflation data and Treasury yield movements.

Source: Yahoo Finance

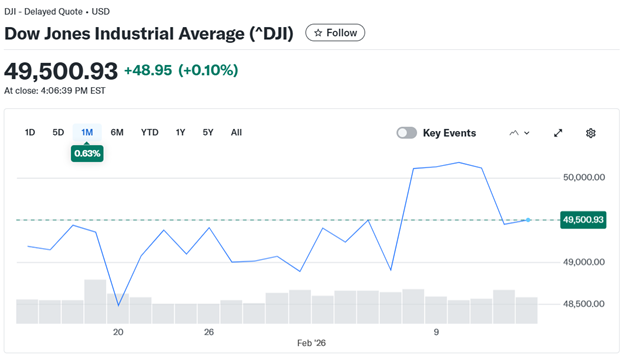

U.S. Equities:

U.S. equity markets experienced elevated volatility during the week as investors weighed stronger-than-expected labor data against moderating inflation. The S&P 500 closed at 6,836.17, finishing marginally higher on Friday but reflecting choppy intra-week trading. The Dow Jones Industrial Average ended at 49,500.93, posting a modest daily gain, while the Nasdaq Composite closed at 22,546.67, slightly lower on the final session as large-cap technology stocks remained under pressure.

Source: Yahoo Finance

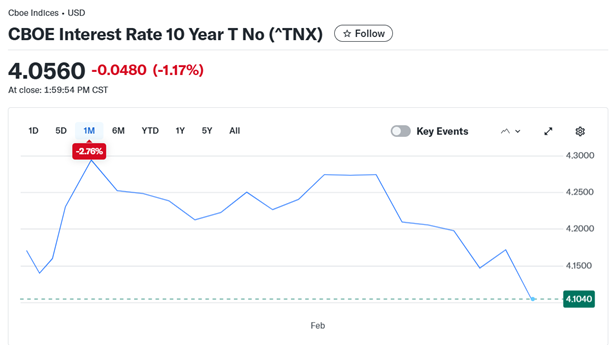

U.S. Bonds:

U.S. Treasury yields declined into the end of the week. The 10-year Treasury yield closed at 4.056%, reflecting renewed demand for duration following the CPI release. Yield movements suggested that markets are balancing moderating inflation against still-solid employment conditions, maintaining expectations for potential rate cuts later in the year without pricing imminent action.

Source: Yahoo Finance

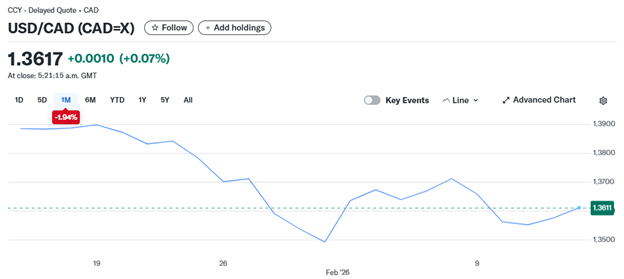

Forex Market:

The U.S. dollar traded within a narrow range against the Canadian dollar. USD/CAD closed at 1.3615, as currency markets reacted to both U.S. macroeconomic data and commodity price movements.

Source: Yahoo Finance

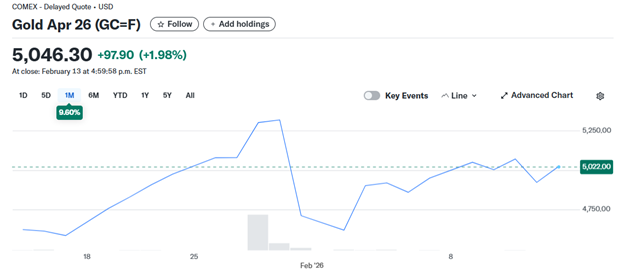

Gold Market& Silver Market:

Precious metals strengthened over the week amid declining Treasury yields and moderating inflation data. Gold closed at 5,046.30, maintaining levels above 5,000, while Silver settled at 77.964. Both metals reflected increased investor positioning in response to evolving rate expectations and broader macroeconomic uncertainty

Source: Yahoo Finance

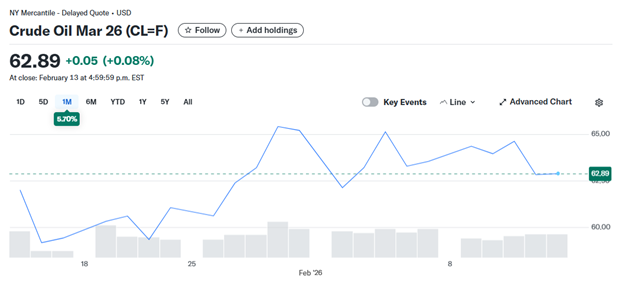

Oil Market:

WTI crude oil traded in a broad range before closing at 62.89 per barrel for the March 2026 contract. Price movements were influenced by global demand expectations, inventory data, and overall risk sentiment. The weekly close suggested a market consolidating near recent levels.

- Let us contact you

Investing with an AimStar's investment professional

Want expert advice at every step of your investing journey?

AimStar’s investment professionals can set you on the right course – and they can meet in-person or online.

Financial Market Data Copyright © 2026 AimStar myportfolio. Data as of February 17 , 2026, 12:30 PM EST

WHAT'S HAPPENING THIS WEEK

February 16 (Monday)

- Key Earnings: Sonoco

February 17 (Tuesday)

- Economic Data & Events: Canada Core CPI (Jan), Canada Wholesale Sales (Dec)

- Key Earnings: Medtronic, Palo Alto Networks

February 18 (Wednesday)

- Economic Data & Events: U.S. Durable Goods Orders (Dec), FOMC Meeting Minutes

- Key Earnings: Analog Devices, eBay, DoorDash

February 19 (Thursday)

- Economic Data & Events: Initial Jobless Claims, Crude Oil Imports

- Key Earnings: Walmart, Newmont, Akamai Technologies

February 20 (Friday)

- Economic Data & Events: U.S. GDP (Q4), U.S. Personal Income & Spending (Dec.), U.S. Core PCE Index (Dec.)

- Key Earning: AngloGold Ashanti

Author by: Sarah San

Edited & Published by: Sarah San

February 17 , 2026 13:00 AM EST. 10 min read

AimStar Capital Group Inc. is a Canadian full-service Investment Dealer, regulated by Canadian Investment Regulatory Organization (CIRO) and a member of Canadian Investor Protection Fund (CIPF). As an independent firm, AimStar is built on a foundation of innovation, integrity, and client-centricity. They are committed to providing unbiased advice and dedicated to the client’s needs, helping them achieve their financial goals.

AimStar is recognized as a Wealth Professionals 5-star Wealth Management Firm for 2024, this award recognized AimStar has offered exceptional client experience, a proven investment track record, continuous innovation, and stringent regulatory compliance.