Key Focus This Week “Jobs Data, Central Bank Signals, and Earnings as Market Catalysts”

Markets enter the week of February 2–6 with attention firmly centered on the U.S. labour market, major corporate earnings, and ongoing reassessment of the monetary-policy outlook. After a volatile prior week marked by sharp moves in precious metals and renewed sensitivity to interest-rate expectations, investors are likely to focus on whether incoming data and earnings results reinforce or challenge the prevailing soft-landing narrative.

The January U.S. employment report, due Friday, represents the most consequential macro release of the week. Following recent indications of moderating economic momentum, labour-market data will be closely examined for confirmation of cooling conditions without a sharp deterioration in hiring or wage growth. Any meaningful deviation from expectations could influence near-term rate-cut pricing and drive volatility across equities, rates, and foreign-exchange markets. In this context, earlier indicators such as ISM manufacturing and services surveys and JOLTS job openings will serve as important lead-ins, shaping expectations ahead of the payrolls release.

Alongside macro data, corporate earnings from large-cap technology and consumer-facing companies are expected to play a central role in market direction. Results from firms such as Alphabet, Amazon, Advanced Micro Devices, Disney, and Palantir will provide insight into key themes including digital advertising demand, cloud and AI-related capital spending, and consumer resilience. With investors increasingly discriminating between growth supported by clear monetization and growth driven by rising costs, earnings guidance and management commentary may have outsized influence on sector leadership and overall risk appetite.

In Canada, while the economic calendar is lighter, markets will continue to digest the implications of the Bank of Canada’s recent rate hold and its emphasis on a softer domestic growth outlook. Currency and equity markets remain sensitive to relative growth and policy divergence between Canada and the United States, particularly as U.S. data continues to set the tone for global risk sentiment.

Key Economic Data & News Review – Last Week

US Federal Reserve Chair Nomination

US monetary policy expectations shifted during the week after President Donald Trump announced the nomination of Kevin Warsh to succeed Jerome Powell as Chair of the Federal Reserve, with Powell’s term set to expire in May 2026 and the appointment subject to Senate confirmation. The announcement introduced a new source of policy uncertainty, as leadership changes at the Fed are often associated with shifts in communication style and the policy reaction function, even when the near-term rate outlook remains unchanged

Warsh previously served as a Federal Reserve Governor from 2006 to 2011, including during the global financial crisis, and earlier worked as an investment banker at Morgan Stanley and as a senior economic adviser in the George W. Bush administration. Since leaving the Fed, he has been an outspoken critic of prolonged accommodative monetary policy, large-scale asset purchases, and balance-sheet expansion, arguing that extended stimulus can distort asset prices and weaken inflation credibility over time. These views have led market participants to characterize Warsh as relatively more policy-conservative compared with some other potential candidates, particularly with respect to inflation risks and the long-term role of central bank intervention.

From a market perspective, the nomination affected expectations around the future path of monetary policy rather than immediate rate decisions, with investors reassessing how quickly policy easing could proceed once leadership changes occur. The development contributed to increased sensitivity in rates markets and a reassessment of medium-term policy risks, with potential implications for financial conditions, the US dollar, and rate-sensitive asset classes. More broadly, the episode underscored how anticipated changes in Fed leadership can influence investor positioning well ahead of any formal shift in policy, reinforcing the importance of institutional factors in shaping economic and investment outcomes.

Central bank decisions: Fed hold set the tone; BoC reinforced soft-growth narrative

Monetary policy developments were a key driver of market dynamics last week, led by the Federal Reserve’s decision to hold the federal funds target range at 3.50% – 3.75%. While the outcome was widely expected, markets focused on the Fed’s acknowledgment of continued disinflation progress alongside signs of moderating economic momentum. Policymakers reiterated that future decisions would remain data-dependent, reinforcing expectations for an extended pause rather than an imminent rate cut. U.S. Treasury yields were volatile around the announcement, firming earlier in the week before easing modestly as investors reassessed the near-term policy path.

In Canada, the Bank of Canada also held its policy rate at 2.25%, aligning with expectations. The accompanying statement highlighted softening domestic economic conditions, including weaker household consumption and slowing investment, while noting further easing in inflation pressures. Canadian government bond yields edged lower following the decision, reflecting growing market conviction that the next policy move is more likely to be easing rather than tightening. Compared with the Fed, the BoC’s messaging emphasized a more fragile growth backdrop, underscoring divergence in economic momentum between Canada and the U.S.

Precious Metals: Record Highs and “Gold on Steroids” Volatility

Gold prices saw extreme volatility over the week. Prices rose steadily early on, climbing from the low-$5,000/oz range at the start of the week to record highs near $5,580–$5,600/oz by mid-week, supported by strong safe-haven demand, a softer U.S. dollar, and declining real yields amid policy and geopolitical uncertainty. The rally reflected increased defensive positioning as investors reacted to central-bank decisions and broader macro risks.

Momentum reversed sharply toward the end of the week. Gold fell back below $5,000/oz by Friday, giving up a substantial portion of earlier gains. The pullback was driven by a firmer U.S. dollar, shifting interest-rate expectations, and profit-taking following the rapid run-up in prices. The move highlighted how sensitive gold prices remained to currency movements and changes in policy-related sentiment.

Silver broadly tracked gold’s trajectory, rising sharply in the first half of the week before declining more aggressively during the late-week selloff, reflecting its higher volatility and thinner market structure. The retreat in precious metals weighed on materials and mining equities, contributing to underperformance in commodity-linked sectors, particularly in Canada.

Corporate Earnings: Divergence in AI Capital Allocation

The technology sector demonstrated a distinct narrowing of the “AI premium” following earnings releases from two major industry leaders. Microsoft (MSFT) shares entered a downward trend, declining approximately 12% as the market focused on a deceleration in Azure cloud growth and the significant capital expenditure required to scale its infrastructure. In contrast, Meta Platforms (META) shares moved in a positive trajectory, gaining nearly 10% as the company demonstrated a direct correlation between its AI investments and advertising margin expansion. This movement highlights a maturing market trend: capital is no longer buoying the sector uniformly; instead, investors are increasingly rewarding companies that demonstrate tangible monetization of AI while penalizing those with rising costs and slower growth conversion.

Investing with an AimStar's investment professional

Want expert advice at every step of your investing journey?

AimStar’s investment professionals can set you on the right course – and they can meet in-person or online.

Market Performance Review – Last Week

Source: Yahoo Finance

Canadian Equities:

Canadian equities underperformed U.S. markets over the week. The S&P/TSX Composite closed at 31,923.52, reflecting broad-based weakness, particularly in commodity-linked sectors following sharp moves in precious metals.

Source: Yahoo Finance

U.S. Equities:

In the U.S., major equity indexes posted more modest declines. The S&P 500 ended the week at 6,939.03, while the Dow Jones Industrial Average closed at 48,892.47. The Nasdaq Composite underperformed relative to other U.S. benchmarks, finishing at 23,461.82, as technology stocks faced increased volatility amid earnings reactions and shifting rate expectations.

Source: Yahoo Finance

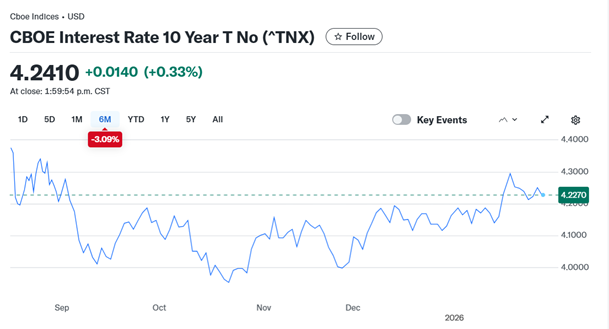

U.S. Bonds:

U.S. Treasury yields moved higher on the week. The U.S. 10-year Treasury yield closed at 4.24%, rising modestly over the period. Yield movements reflected ongoing reassessment of the near-term interest-rate outlook following the Federal Reserve’s policy decision and related macro developments.

Source: Yahoo Finance

Forex Market:

The Canadian dollar weakened against the U.S. dollar. USD/CAD closed at 1.3616, as relative economic momentum and rate expectations continued to favor the U.S. dollar.

Source: Yahoo Finance

Gold Market:

Precious metals experienced significant volatility. Gold settled at $4,875.40, following a sharp late-week pullback that erased a substantial portion of earlier gains. Silver declined even more sharply, closing at $83.82, underscoring elevated volatility in the precious-metals complex.

Source: Yahoo Finance

Oil Market:

Energy prices moved higher. WTI crude oil (Mar) closed at $65.79, supported by a late-week rebound after earlier weakness.

- Let us contact you

Investing with an AimStar's investment professional

Want expert advice at every step of your investing journey?

AimStar’s investment professionals can set you on the right course – and they can meet in-person or online.

Financial Market Data Copyright © 2026 AimStar myportfolio. Data as of February 2 , 2025, 12:30 PM EST

WHAT'S HAPPENING THIS WEEK

February 2 (Monday)

- Economic Data & Events: U.S. ISM Manufacturing PMI (Jan).

- Key Earnings: Palantir, Walt Disney.

February 3 (Tuesday)

- Economic Data & Events: U.S. JOLTS Job Openings (Dec).

- Key Earnings: PayPal, PepsiCo, Pfizer, Advanced Micro Devices (AMD).

February 4 (Wednesday)

- Economic Data & Events: Eurozone CPI (Jan), U.S. Service PMI (Jan), U.S. ISM Non-Manufacturing PMI (Jan), U.S. Crude Oil Inventories.

- Key Earnings: Alphabet, Uber Technologies, ARM, Qualcomm, Eli Lilly.

February 5 (Thursday)

- Economic Data & Events: The European Central Bank Interest Rate Decisions, U.S. Initial Jobless Claim.

- Key Earnings: Amazon, Shell.

February 6 (Friday)

- Economic Data & Events: U.S. Employment Report (Jan), U.S. Unemployment Rate (Jan), U.S. Average Hourly Earnings (Jan).

- Key Earnings: Toyota, Cboe Global Markets.

Author by: Sarah San

Edited & Published by: Sarah San

February 2 , 2026 13:00 AM EST. 10 min read

AimStar Capital Group Inc. is a Canadian full-service Investment Dealer, regulated by Canadian Investment Regulatory Organization (CIRO) and a member of Canadian Investor Protection Fund (CIPF). As an independent firm, AimStar is built on a foundation of innovation, integrity, and client-centricity. They are committed to providing unbiased advice and dedicated to the client’s needs, helping them achieve their financial goals.

AimStar is recognized as a Wealth Professionals 5-star Wealth Management Firm for 2024, this award recognized AimStar has offered exceptional client experience, a proven investment track record, continuous innovation, and stringent regulatory compliance.