Key Focus This Week “Earnings Season, Inflation Data, and Geopolitical Risks Set the Stage for Market Direction”

As markets enter the trading week of January 13, investor attention is expected to coalesce around the official start of the fourth-quarter earnings season alongside a series of scheduled economic data releases that could shape expectations for inflation and interest rates. Major U.S. financial institutions, including JPMorgan Chase & Co., Bank of America, BlackRock, Citigroup, Wells Fargo, Morgan Stanley, and Goldman Sachs, are slated to report results, with market participants focused on guidance around credit conditions, net interest income, and capital deployment amid shifting macro conditions.

In addition to earnings, key U.S. economic releases scheduled for the week, including the December Consumer Price Index and other inflation-related indicators, stand to influence market expectations for monetary policy and Treasury yields. Consensus forecasts indicate ongoing moderation in inflation, but outcomes that differ materially from expectations could recalibrate pricing in rates and risky assets. Core macro signals this week will be pivotal for validating early thematic trends in equities and fixed income.

Adding to these scheduled drivers, geopolitical developments remain a significant background factor for markets. The ongoing U.S.–Venezuela situation continues to influence energy sector positioning and safe-haven demand, with past headlines linked to higher energy stocks and gold as investors weigh potential disruption to Venezuelan crude flows and broader geopolitical risk. While immediate supply impacts are likely to be modest given Venezuela’s constrained output and global oversupply, market sensitivity to geopolitical risk premiums could persist, particularly if related headlines evolve further.

Last Week’s Key Economic Data & News Recap

U.S. Equity Markets Extend Gains, Led by Energy and Financials

U.S. equity markets continued to advance during the week, with the Dow Jones Industrial Average reaching fresh record highs as gains were driven by strength in energy and financial stocks. Elevated oil prices and improving sentiment around economic resilience supported cyclical sectors, contributing to broad-based market momentum.

Investor optimism has also been underpinned by expectations for a constructive economic environment in 2026, even as markets remain attentive to potential risks. The combination of strong index performance and sector leadership reflects sustained risk appetite, though positioning appears increasingly sensitive to macro and policy developments.

Labor Market Data in Focus as Investors Assess Policy Implications

Labor market data remained a key focus last week. The latest U.S. employment report showed that nonfarm payrolls increased by only around 50,000 in December 2025, below market expectations, while the unemployment rate edged down to 4.4% from 4.5% in November, pointing to a clear slowdown and overall softness in labor market growth. At the same time, investors continued to monitor job openings and upcoming employment indicators, with recent data reinforcing expectations of gradually cooling labor demand. As a result, labor market developments remain closely linked to interest rate expectations, particularly regarding the timing and pace of potential policy adjustments.

Venezuela Developments Contribute to Commodity and Safe-Haven Demand

Geopolitical developments involving Venezuela drew market attention during the week, contributing to heightened uncertainty in energy markets. Reports surrounding political tensions and potential shifts in U.S. policy toward Venezuela prompted investors to reassess regional risk, adding upward pressure to oil prices despite Venezuela’s relatively modest share of global crude supply.

At the same time, increased geopolitical uncertainty supported demand for safe-haven assets, with gold prices moving higher as investors sought hedges against potential volatility. While the longer-term implications remain unclear, these developments added to short-term risk premiums across commodities and reinforced sensitivity to geopolitical headlines.

Housing and Policy-Related Headlines Add to Broader Inflation Narrative

Last week, U.S. housing policy came into focus after President Trump proposed restricting large institutional investors from purchasing single-family homes, aiming to improve housing affordability and prioritize individual and family buyers. The proposal has raised discussion around potential shifts in real estate investment dynamics, as institutional participation has been linked to upward pressure on home prices and rents. Markets will closely watch policy feasibility and implementation details in the near term, while longer-term impacts will depend on legislative progress and housing supply conditions.

Investing with an AimStar's investment professional

Want expert advice at every step of your investing journey?

AimStar’s investment professionals can set you on the right course – and they can meet in-person or online.

Last Week’s Market Performance Recap

Source: Yahoo Finance

Canadian Equities:

Canadian equities ended the week higher, with the S&P/TSX Composite closing at 32,612.93. The index extended its positive start to 2026, supported by broad-based participation across sectors and sustained investor interest in commodities and financials, reflecting continued strength in energy and materials markets. Overall, rising oil and precious metals prices provided ongoing support for resource-linked sectors, contributing to the TSX’s solid performance.

Source: Yahoo Finance

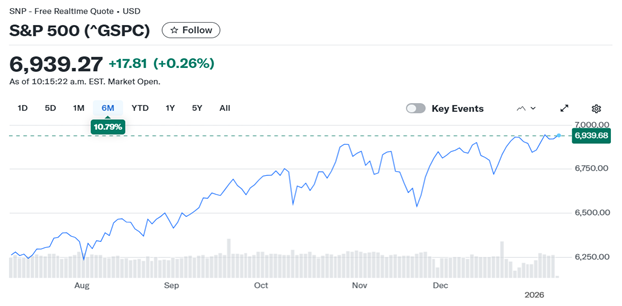

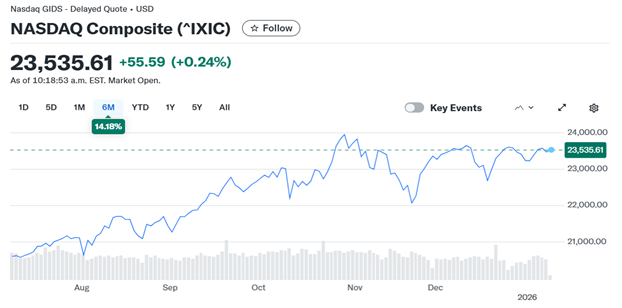

U.S. Equities:

U.S. equity markets closed the week higher, extending their positive start to the year. The Dow Jones Industrial Average finished at 49,504.07, while the S&P 500 and Nasdaq Composite closed at 6,966.28 and 23,671.35, respectively. Gains were broad-based across major indices, reflecting sustained investor participation and continued confidence in large-cap equities. Market sentiment remained sensitive to macroeconomic developments and upcoming earnings releases, which are expected to provide further insight into corporate fundamentals and broader economic conditions.

Source: Yahoo Finance

U.S. Bonds:

U.S. Treasury yields were relatively stable over the week, with the benchmark 10-year yield closing at 4.171%, as investors balanced equity strength against evolving inflation and policy expectations.

Source: Yahoo Finance

Forex Market:

In currency markets, USD/CAD closed at 1.3911, reflecting a steady U.S. dollar and limited directional movement over the week.

Source: Yahoo Finance

Gold Market:

Gold closed at $4,518.40 per ounce, supported by continued demand for defensive assets amid ongoing geopolitical and macroeconomic uncertainty.

Silver ended the week at $79.79 per ounce, with price movements reflecting broader market risk sentiment.

Source: Yahoo Finance

Oil Market:

WTI crude oil prices closed the week at $58.78/bbl, with energy markets remaining sensitive to geopolitical developments as well as evolving global supply-demand dynamics. Price action reflected ongoing assessments of geopolitical risk premiums and broader fundamentals in the energy market.

- Let us contact you

Investing with an AimStar's investment professional

Want expert advice at every step of your investing journey?

AimStar’s investment professionals can set you on the right course – and they can meet in-person or online.

26Financial Market Data Copyright © 2026 AimStar myportfolio. Data as of January 12, 2026, 12:30 PM EST6

WHAT'S HAPPENING THIS WEEK

January 12 (Monday)

- Economic Data & Events: New York Fed President John Williams speaks

January 13 (Tuesday)

- Economic Data & Events: U.S. Consumer Price Index (CPI) for December

- Key Earnings: JPMorgan Chase & Co., BNY Mellon

January 14 (Wednesday)

- Economic Data & Events: U.S. Producer Price Index (PPI) for November, U.S. Retail Sales (November)

- Key Earnings: Wells Fargo, Citigroup, Bank of America

January 15 (Thursday)

- Economic Data & Events: Initial Jobless Claims

- Key Earnings: Morgan Stanley, Goldman Sachs, BlackRock

January 16 (Friday)

- Economic Data & Events: Industrial Production

- Key Earning: State Street

Author by: Sarah San

Edited & Published by: Sarah San

January 12, 2026, 12:30 PM EST. 10 min read

AimStar Capital Group Inc. is a Canadian full-service Investment Dealer, regulated by Canadian Investment Regulatory Organization (CIRO) and a member of Canadian Investor Protection Fund (CIPF). As an independent firm, AimStar is built on a foundation of innovation, integrity, and client-centricity. They are committed to providing unbiased advice and dedicated to the client’s needs, helping them achieve their financial goals.

AimStar is recognized as a Wealth Professionals 5-star Wealth Management Firm for 2024, this award recognized AimStar has offered exceptional client experience, a proven investment track record, continuous innovation, and stringent regulatory compliance.