Key Focus This Week “Delayed U.S. Economic Data and Earnings Set to Shape Market Direction”

Market attention is expected to shift toward a dense slate of U.S. economic data releases scheduled for the week ahead, following the postponement of several major reports in the prior week. In particular, the delayed January employment report is likely to be a central focus for investors assessing labor market conditions and the broader economic outlook. With recent market volatility driven largely by earnings-related and sector-specific factors, incoming macro data may play a more prominent role in shaping near-term sentiment.

In addition to labor market data, investors will closely monitor upcoming U.S. inflation and retail sales figures for further insight into demand conditions and pricing trends. Together, these releases are expected to inform expectations around the policy outlook and help clarify whether recent moderation in market momentum reflects a temporary pause or a broader reassessment of growth assumptions.

Corporate earnings will also remain in focus, with several high-profile companies across technology, consumer, and industrial sectors scheduled to report. Market reactions are likely to center on forward guidance and margin commentary, particularly in an environment where investors have shown heightened sensitivity to valuation levels and capital expenditure plans.

Overall, the week ahead presents a more data-intensive backdrop compared with the prior period, with postponed macro releases and ongoing earnings developments set to test market conviction following recent volatility.

Key Economic Data & News Review – Last Week

U.S. Equity Markets Moderated After Early-Week Advances

U.S. equity markets traded with elevated volatility as large-cap growth and technology stocks weighed on overall performance. While the S&P 500 and Nasdaq opened the week with modest gains, risk-off sentiment intensified mid-week amid evolving investor focus on earnings reports and heavy AI-related capital spending plans, leading to broader market weakness before a modest rebound by the end of the period. Fund flow data showed a marked reduction in demand for U.S. equity funds, particularly in the technology sector, even as industrial and value-oriented areas attracted inflows, indicating shifting investor preferences.

Mixed Earnings and Sector Rotation Drove Market Nuances

Earnings releases continued to shape market positioning. Some companies reported results in line with expectations, but investor responses increasingly hinged on forward guidance and capital allocation intentions rather than headline profits alone. Technology firms faced scrutiny over expansive spending commitments in emerging areas such as generative AI, which contributed to selective selling in software-related stocks and broader risk aversion in growth-oriented equities. This combination of earnings developments and sector rotation underpinned uneven trading patterns throughout the week.

Bitcoin & Crypto Markets Showed Heightened Volatility

Cryptocurrency markets experienced significant volatility, with Bitcoin slipping below important support levels and erasing gains accumulated since late-2024. The decline reflected a combination of thin liquidity conditions in digital assets and broader risk-off dynamics in traditional markets, amplifying price swings. Bitcoin’s retreat below the US $70,000 threshold was widely covered as a notable development in crypto pricing, highlighting ongoing uncertainty about liquidity and investor positioning in the sector.

Investing with an AimStar's investment professional

Want expert advice at every step of your investing journey?

AimStar’s investment professionals can set you on the right course – and they can meet in-person or online.

Market Performance Review – Last Week

Source: Yahoo Finance

Canadian Equities:

the S&P/TSX Composite Index moved higher, ending the week at 32,470.98, up 1.71%, reflecting broadly positive equity performance across North American markets.

Source: Yahoo Finance

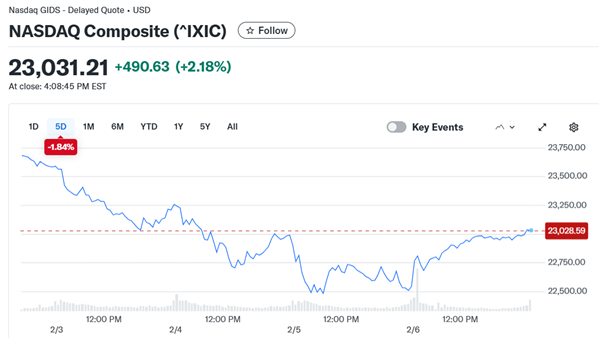

U.S. Equities:

U.S. equities delivered mixed performance over the week. The Dow Jones Industrial Average rose 2.50% to 50,115.67, while the S&P 500 declined 0.10% to 6,932.27 and the Nasdaq Composite fell 1.84% to 23,031.21.

Source: Yahoo Finance

U.S. Bonds:

The U.S. 10-year Treasury yield edged lower over the week, closing at 4.206%, down 0.83%, indicating a slight decline in long-term borrowing costs and generally stable sentiment in fixed income markets.

Source: Yahoo Finance

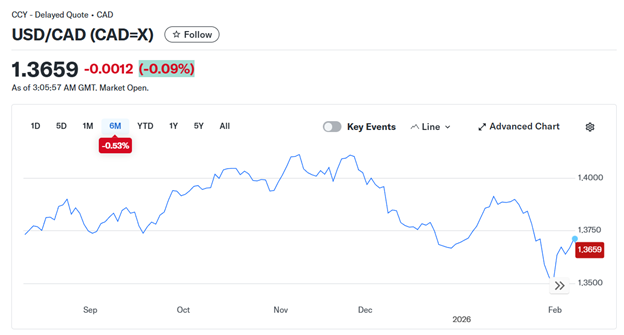

Forex Market:

In currency markets, the Canadian dollar strengthened modestly against the U.S. dollar, with USD/CAD closing at 1.3712.

Source: Yahoo Finance

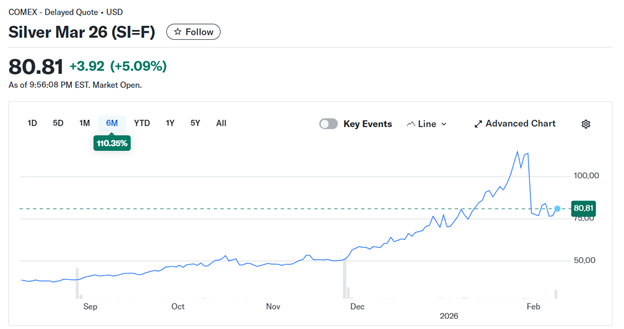

Gold Market:

Gold prices remained elevated, ending the week at US$4,951.20, while silver closed at US$76.735. Gold and silver experienced notable volatility during the week, with prices retreating from recent highs and silver seeing sharp moves as margin requirements were raised in futures markets.

Source: Yahoo Finance

Oil Market:

In energy markets, WTI crude oil prices declined, finishing the week at US$63.55, after sliding amid easing geopolitical tensions and broad commodity weakness.

- Let us contact you

Investing with an AimStar's investment professional

Want expert advice at every step of your investing journey?

AimStar’s investment professionals can set you on the right course – and they can meet in-person or online.

Financial Market Data Copyright © 2026 AimStar myportfolio. Data as of February 9 , 2025, 12:30 PM EST

WHAT'S HAPPENING THIS WEEK

February 9 (Monday)

- Key Earnings:Onsemi, Apollo, CNA Financial.

February 10 (Tuesday)

- Economic Data & Events: U.S. Retail Sales (Dec)

- Key Earnings: Coca Cola, CVS Health, Spotify, S&P Global.

February 11 (Wednesday)

- Economic Data & Events: U.S. Employment Report (Jan), U.S. Unemployment rate (Jan), U.S. Average Hourly Earning (Jan).

- Key Earnings: Shopify, Unity, McDonald’s, Cisco.

February 12 (Thursday)

- Economic Data & Events: U.S. Initial Jobless Claims

- Key Earnings: Coinbase, Arista Network, Brookfield

February 13 (Friday)

- Economic Data & Events: U.S. CPI (Jan), U.S. Core CPI (Jan)

- Key Earning: Moderna, Magna

Author by: Sarah San

Edited & Published by: Sarah San

February 9 , 2026 13:00 AM EST. 10 min read

AimStar Capital Group Inc. is a Canadian full-service Investment Dealer, regulated by Canadian Investment Regulatory Organization (CIRO) and a member of Canadian Investor Protection Fund (CIPF). As an independent firm, AimStar is built on a foundation of innovation, integrity, and client-centricity. They are committed to providing unbiased advice and dedicated to the client’s needs, helping them achieve their financial goals.

AimStar is recognized as a Wealth Professionals 5-star Wealth Management Firm for 2024, this award recognized AimStar has offered exceptional client experience, a proven investment track record, continuous innovation, and stringent regulatory compliance.