Key Focus This Week “ Earnings Release Season: Spotlight on Tech, Pharma, and Consumer Sectors”

Last week, several major corporations released strong earnings reports, and this trend is expected to continue this week. The market is focusing on upcoming earnings from technology companies, consumer brands, and pharmaceutical firms. AI data analytics firm Palantir, chipmaker AMD, and ride-hailing platform Uber will be among the first to report results. McDonald’s and Disney are also set to release their quarterly results this week.

Palantir will report on Monday, with its stock price near historical highs, fueled by ongoing enthusiasm around AI spending. AMD plans to release its report on Tuesday, with high expectations surrounding its MI350 series chips, potentially rivalling Nvidia. Uber is set to report Wednesday, with analysts generally optimistic about its outlook.

In the consumer sector, McDonald’s will report on Wednesday. Due to weakening confidence among middle-income consumers, McDonald’s noted a decline in customer traffic. Disney will also report on the same day and previously raised its full-year profit forecast due to growth in streaming subscriptions.

In pharmaceuticals, Denmark-based Novo Nordisk will report on Wednesday. The company recently lowered its full-year forecast due to declining sales of its weight-loss drugs Ozempic and Wegovy. Eli Lilly will report Thursday, having cut profit guidance in May due to high R&D costs.

On the data front, the U.S. June trade deficit will be released Tuesday amid shifts in global trade from tariff changes. This data may provide insight into whether tariffs are boosting U.S. manufacturing. Second-quarter productivity data will also be watched closely, as investors assess AI’s impact on labor efficiency.

On Thursday, initial jobless claims and June consumer credit data will offer further signals on U.S. consumer spending and labor market health.

The Fed held interest rates steady last week, but two FOMC members voted in favor of a rate cut. Investors will be watching speeches by Fed officials this week—including San Francisco Fed President Daly, Atlanta Fed President Bostic, and St. Louis Fed President Musalem—for clues on future policy.

Key Economic Data & News Review – Last Week

ADP: U.S. private sector added 104,000 jobs in July, beating expectations of 76,000

Private employers added more jobs than expected in July, rebounding after a rare decline in May. ADP data released last Wednesday showed private sector jobs rose by 104,000 in July—well above the 75,000 estimate and much stronger than June’s revised decline of 23,000 (originally reported as -33,000). ADP’s wage insights show job-switchers saw annual pay increases of 7% (unchanged from June), while job-stayers saw 4.4% wage growth, down from 4.5% in June.

U.S. Q2 GDP grows 3%, above 2.6% forecast

June new home sales remained sluggish despite aggressive builder incentives. Sales rose 0.6% to an annualized 627,000 units—below the 650,000 consensus. Even with mortgage subsidies and pricing discounts, high home prices and borrowing costs continue to hinder buyers and hurt builders’ margins.

U.S. June job openings fell to 7.44 million

Job openings fell after two months of increases, signaling a cooling but still stable labor market. Openings dropped from May’s revised 7.71 million to 7.44 million in June. The figures show a slow cooling pace, with openings still above pre-pandemic averages, but hiring has slowed and job searches are taking longer.

U.S. Q2 GDP beats expectations

The Bureau of Economic Analysis reported GDP declined 0.5% in Q2. A survey of 69 economists expected growth ranging from +0.8% to +4.5%. Consumer spending rose 1.4% (vs. 0.5% in Q1). The GDP price index rose 2% (vs. 3.8% prior), and core PCE rose 2.5% (vs. 3.5% prior).

Fed holds rates for fifth straight meeting; two dissenters call for cuts

On July 30, the Fed kept the federal funds rate at 4.25%–4.5%, marking five consecutive meetings with no change. Two FOMC members dissented, voting for a rate cut—the highest dissent count since the pause began. The Fed softened its economic language, removing “uncertainty easing” and emphasizing ongoing uncertainty amid slowing growth.

U.S. June core PCE rises 2.8% YoY, a 4-month high

The PCE and core PCE indexes both rose in June. Headline PCE was up 2.6% YoY (vs. 2.5% expected); core PCE rose 2.8% (vs. 2.7% expected). Inflation pressures remain, particularly in services, household goods, and healthcare—driven by tariffs and trade disruptions.

U.S. nonfarm payrolls miss expectations

Payrolls grew by just 73,000 in July, below forecasts and revised downward for the prior two months by nearly 260,000 jobs. The unemployment rate rose to 4.2%. The data reflect a sharper slowdown in labor market momentum, with longer job searches, stagnant wage growth, and increased economic risk.

Investing with an AimStar's investment professional

Want expert advice at every step of your investing journey?

AimStar’s investment professionals can set you on the right course – and they can meet in-person or online.

Market Performance Review – Last Week

Source: Yahoo Finance

Canadian Equities:

Ahead of the Civic Holiday long weekend, Canadian markets fell sharply. Investor sentiment weakened due to trade tensions, mixed earnings, and weaker oil prices. The S&P/TSX Composite Index dropped 239 points (-0.9%) to 27,020—the largest single-day drop in three months. All major sectors fell, led by tech, healthcare, and financials.

Source: Yahoo Finance

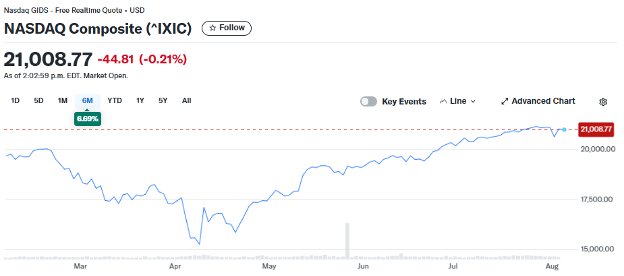

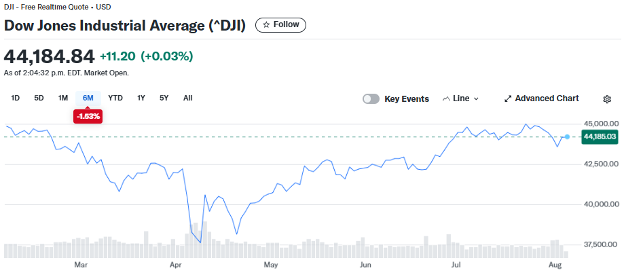

U.S. Equities:

U.S. equities had a volatile week. All three major indexes posted losses, ending a multi-week uptrend. The S&P 500 fell for the fourth straight day, pressured by tariff headlines and weak tech earnings. Poor July payroll data increased bets on a Fed rate cut in September. S&P 500 fell 2.4% for the week—its worst since May 23. The Dow dropped 2.9% (worst since April 4), and the Nasdaq fell 2.2%.

Source: Yahoo Finance

U.S. Bonds:

The 10-year Treasury yield dropped to 4.21%, down 17.59 basis points for the week. The 2-year yield fell to 3.67%, down 25.59 basis points.

Source: Yahoo Finance

Forex Market:

The U.S. Dollar Index rose 1.44% to 99.05. The Canadian dollar weakened to 1.38 vs USD—the weakest since May 22.

Source: Yahoo Finance

Gold Market:

Spot gold rose 0.74% to $3,362.15/oz, buoyed by weak payroll data, rising Fed cut expectations, and tariff-driven safe haven demand.

Source: Yahoo Finance

Oil Market:

WTI September futures rose 3.33% to $67.33/barrel.

- Let us contact you

Investing with an AimStar's investment professional

Want expert advice at every step of your investing journey?

AimStar’s investment professionals can set you on the right course – and they can meet in-person or online.

Financial Market Data Copyright © 2025 AimStar myportfolio. Data as of August 5, 2025, 12:30 PM EST

WHAT'S HAPPENING THIS WEEK

August 4 (Monday)

• Economic Data/Events: June Factory Orders

• Key Earnings: Palantir, Vertex Pharmaceuticals (VRTX), Williams Cos. (WMB), Axon Enterprise (AXON)

August 5 (Tuesday)

• Economic Data/Events: June Trade Deficit, July S&P U.S. Services PMI Final, July ISM Services PMI

• Key Earnings: AMD, Caterpillar (CAT), Amgen, Eaton Corp. (ETN), Arista Networks (ANET), Pfizer

August 6 (Wednesday)

• Economic Data/Events: Speech by San Francisco Fed President Daly

• Key Earnings: Novo Nordisk, McDonald’s, Disney, Uber, Shopify (SHOP), Sony, Applovin (APP), DoorDash, Airbnb

August 7 (Thursday)

• Economic Data/Events: Weekly Jobless Claims, Q2 Productivity, June Wholesale Inventories, June Consumer Credit, Speech by Atlanta Fed President Bostic

• Key Earnings: Eli Lilly, Gilead Sciences (GILD), ConocoPhillips, Constellation Energy (CEG), Motorola Solutions (MSI), Monster Beverage (MNST)

August 8 (Friday)

• Economic Data/Events: Speech by St. Louis Fed President Musalem

Author by: Mark Ma

Edited & Published by: Sarah San

August 5 , 2025 13:00 AM EST. 10 min read

AimStar Capital Group Inc. is a Canadian full-service Investment Dealer, regulated by Canadian Investment Regulatory Organization (CIRO) and a member of Canadian Investor Protection Fund (CIPF). As an independent firm, AimStar is built on a foundation of innovation, integrity, and client-centricity. They are committed to providing unbiased advice and dedicated to the client’s needs, helping them achieve their financial goals.

AimStar is recognized as a Wealth Professionals 5-star Wealth Management Firm for 2024, this award recognized AimStar has offered exceptional client experience, a proven investment track record, continuous innovation, and stringent regulatory compliance.