Key Focus This Week “ Spotlight on Nvidia Earnings and Key Inflation Data”

U.S. stocks surged last Friday amid growing expectations of a rate cut next month. This week, market attention is expected to shift to the earnings report of Nvidia — the world’s most valuable company — and the Fed’s preferred inflation gauge, the PCE Index. Both events could play a crucial role in shaping market direction and monetary policy expectations.

Nvidia is set to report its second-quarter earnings on Wednesday. Investors are watching closely to see whether the company can maintain its lead in the AI chip market. Despite facing headwinds from Chinese export restrictions, the market still anticipates another record-setting performance. Previously, Nvidia warned that export curbs could have an $8 billion impact but also revealed that it is working with the Trump administration to share revenue from AI chip sales in China and is considering launching new products in advance of government approvals.

Other major tech firms are also scheduled to report earnings this week, including chipmaker Marvell, Dell, cybersecurity company CrowdStrike, cloud services provider Snowflake, and engineering software firm Autodesk. In addition, several Canadian banks will be releasing their financial results.

On Friday, the July Personal Consumption Expenditures (PCE) Price Index — the Fed’s most closely watched inflation measure — will be released. The June PCE report showed a slight uptick in inflation, but similar data for July suggested that price increases may have eased. Following dovish comments last week from Fed Chair Jerome Powell, market expectations for a September rate cut have grown stronger, making this PCE release particularly significant for future policy decisions.

Other key data due this week include consumer sentiment surveys, the U.S. trade balance, and housing market indicators — all of which will offer further insights into the state of the economy.

Last Week’s Key Economic Data & News Recap

Powell Highlights Employment Risks at Jackson Hole, Opens Door to Rate Cuts

Federal Reserve Chair Jerome Powell delivered a pivotal speech at the Jackson Hole central banking symposium, emphasizing rising downside risks to employment and signaling that these shifting dynamics may warrant interest rate cuts.

Powell noted that the current economic landscape suggests a growing vulnerability in the labor market. While labor indicators remain stable, he said this allows the Fed to cautiously reassess its policy stance. The evolving outlook and risk balance may call for an adjustment in monetary policy.

He described the labor market as reaching a “peculiar balance,” with both supply and demand having cooled significantly — a development that increases the risk of job losses. In the short term, Powell said, the Fed sees upside risks to inflation but growing downside risks to employment, presenting a challenging environment for policymakers.

Notably, Powell signaled changes to the Fed’s policy framework, including the removal of language that sought to average 2% inflation over time or to use deviations from full employment as a key basis for policy decisions.

In an analysis by The Wall Street Journal’s Nick Timiraos, Powell’s remarks were interpreted as laying the groundwork for a possible rate cut as early as September. Timiraos also noted that Powell, for the first time, expressed greater confidence in the assumption that tariffs would have only a temporary effect on prices.

U.S. August Markit Manufacturing PMI Unexpectedly Hits Over Three-Year High

On Thursday, August 21, data released by S&P Global showed that stronger demand drove U.S. manufacturing activity to expand at its fastest pace in over three years. The preliminary Markit Manufacturing PMI for August came in at 53.3, significantly above expectations of 49.7 and the previous reading of 49.8. This marks the highest level since May 2022.

The rebound in manufacturing also helped lift the Composite PMI — which includes services — to its highest level so far this year. However, the data also pointed to mounting inflationary pressures, as firms showed stronger pricing power and increasingly passed on tariff-related cost increases to customers.

U.S. Labor Market Cools Further as Jobless Claims Spike and Continuing Claims Hit Four-Year High

Data released by the U.S. Department of Labor on Thursday, August 21, showed further signs of a cooling labor market. For the week ending August 16, initial jobless claims unexpectedly surged to 235,000 — the highest level since June and well above both expectations and the prior reading. The four-week moving average also rose to a one-month high.

Meanwhile, for the week ending August 9, continuing claims climbed to 1.972 million, the highest since November 2021. The increase suggests that finding new employment is becoming more difficult for those who have already lost their jobs.

Investing with an AimStar's investment professional

Want expert advice at every step of your investing journey?

AimStar’s investment professionals can set you on the right course – and they can meet in-person or online.

Last Week’s Market Performance Recap

Source: Yahoo Finance

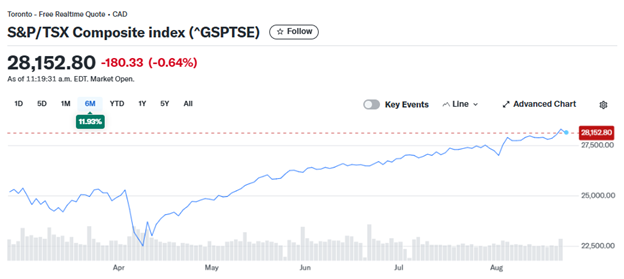

Canadian Equities:

Boosted by soaring metal prices and renewed expectations of a Federal Reserve rate cut, Canadian stocks rose on Friday, extending a record-setting rally. The S&P/TSX Composite Index gained 1%, closing at 28,333 — marking its second consecutive record close and the third straight week of gains for the benchmark index.

Source: Yahoo Finance

U.S. Equities:

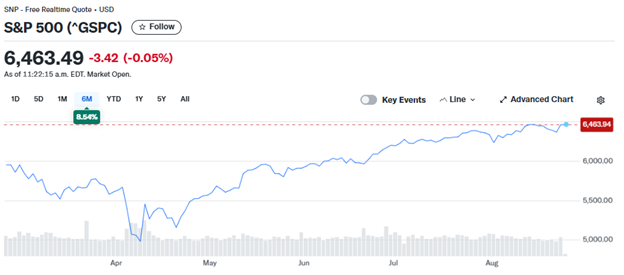

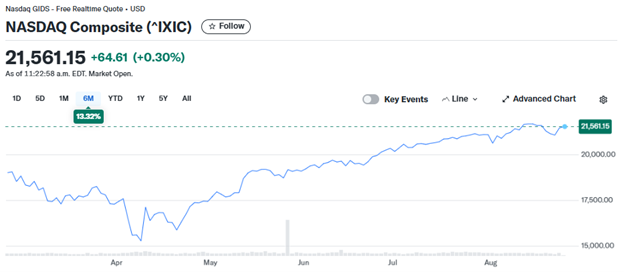

Last week, the U.S. stock market ended with mixed performance. The S&P 500 and Dow Jones Industrial Average both closed higher, while the Nasdaq Composite fell by 0.6% as investors sold off large-cap tech stocks in favor of more reasonably priced shares.

The S&P 500 closed at 6,466.91, nearing its record closing high of 6,468.54 set on August 14. The Dow Jones ended at 45,631.74, surpassing its previous all-time closing high of 45,014.04 set on December 4, 2024. In contrast, the Nasdaq Composite closed lower at 21,496.535.

Source: Yahoo Finance

U.S. Bonds:

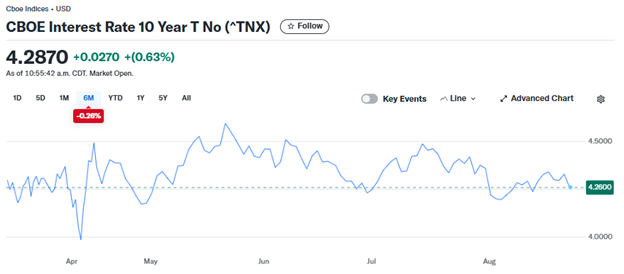

Last week, the yield on the U.S. 10-year benchmark Treasury note closed at 4.25%, marking a weekly decline of 6.22 basis points. Meanwhile, the 2-year Treasury yield ended at 3.71%, down 3.62 basis points over the week.

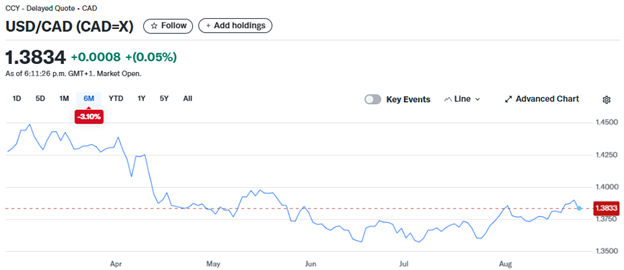

Source: Yahoo Finance

Forex Market:

The U.S. Dollar Index closed at 97.74, after a week of choppy upward movement. It peaked at 98.83 ahead of Fed Chair Jerome Powell’s speech, before pulling back to 97.56 afterward. Over the week, the U.S. dollar gained 0.05% against the Canadian dollar.

Source: Yahoo Finance

Gold Market:

Last week, gold closed at $3,371.86 per ounce, recording a weekly gain of 1.07%.

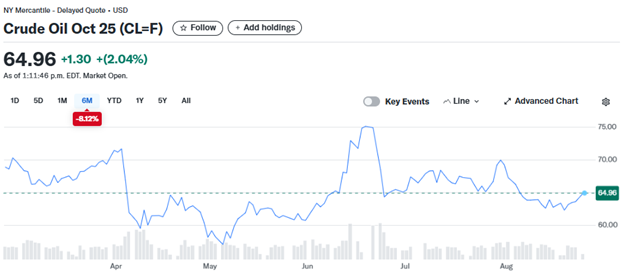

Source: Yahoo Finance

Oil Market:

WTI October crude oil futures closed at $63.66 per barrel, gaining 2.71% over the week. Brent October crude futures ended at $67.73 per barrel, rising more than 2.85% during the same period.

- Let us contact you

Investing with an AimStar's investment professional

Want expert advice at every step of your investing journey?

AimStar’s investment professionals can set you on the right course – and they can meet in-person or online.

25Financial Market Data Copyright © 2025 AimStar myportfolio. Data as of August 25, 2025, 12:30 PM EST

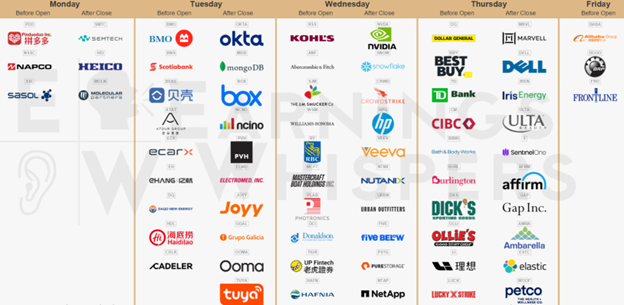

WHAT'S HAPPENING THIS WEEK

August 25 (Monday)

- Economic Data & Events: July new home sales released.

- Key Earnings: PDD Holdings.

August 26 (Tuesday)

- Economic Data & Events: August consumer confidence index, July durable goods orders, June S&P Case-Shiller home price index.

- Key Earnings: Bank of Montreal (BMO), Bank of Nova Scotia (BNS), MongoDB (MDB), Okta (OKTA).

August 27 (Wednesday)

- Economic Data & Events: Richmond Fed President Tom Barkin speaks again.

- Key Earnings: Nvidia, Royal Bank of Canada (RY), CrowdStrike, Snowflake, Veeva Systems, Agilent Technologies, HP.

August 28 (Thursday)

- Economic Data & Events: Preliminary Q2 GDP revision, initial jobless claims for the week ending August 23, pending home sales for July.

- Key Earnings: Toronto Dominion Bank (TD), Dell Technologies, Canadian Imperial Bank of Commerce (CIBC), Marvell Technology, Autodesk, Li Auto, Affirm Holdings, Dollar General.

August 29 (Friday)

- Economic Data & Events: July Personal Consumption Expenditures (PCE) Price Index (Fed’s preferred inflation gauge).

Author by: Mark Ma

Edited & Published by: Sarah San

August 25 , 2025 13:00 AM EST. 10 min read

AimStar Capital Group Inc. is a Canadian full-service Investment Dealer, regulated by Canadian Investment Regulatory Organization (CIRO) and a member of Canadian Investor Protection Fund (CIPF). As an independent firm, AimStar is built on a foundation of innovation, integrity, and client-centricity. They are committed to providing unbiased advice and dedicated to the client’s needs, helping them achieve their financial goals.

AimStar is recognized as a Wealth Professionals 5-star Wealth Management Firm for 2024, this award recognized AimStar has offered exceptional client experience, a proven investment track record, continuous innovation, and stringent regulatory compliance.