Key Focus This Week “ All Eyes on Powell’s Jackson Hole Speech as Markets Watch for Rate Signals”

This week, market attention will turn to the American West as the annual Jackson Hole Economic Policy Symposium kicks off. Federal Reserve Chair Jerome Powell is expected to deliver a closely watched speech, joined by global central bankers, economists, and senior government officials. Investors will be listening carefully for any clues about the future direction of U.S. interest rates.

Expectations for a rate cut at the Fed’s September meeting have been rising. The Fed has not lowered rates since last December but is now facing growing pressure from President Trump and other administration officials to ease borrowing costs. BMO Senior Economist Jennifer Lee noted the Fed is in a tough spot — inflation is ticking higher, while the labor market appears weaker than previously thought.

Meanwhile, the minutes from the Fed’s July FOMC meeting will also be released this week, potentially shedding light on policymakers’ views on the economy and interest rates. The minutes may also provide insight into why two members dissented and voted in favor of a rate cut at that meeting.

Beyond central bank developments, markets will also digest U.S. housing data and weekly jobless claims, offering more insight into the current state of the economy.

On the corporate front, earnings from major retailers will be in focus as investors assess whether tariff pressures are starting to impact profit margins. Walmart is set to report on Thursday, having previously said it may raise prices to offset tariff-related costs. Home Depot is trying to maintain its pricing structure, with more details expected in Tuesday’s earnings report.Target will report on Wednesday, following earlier warnings that sales may fall short of projections. TJX, parent of T.J. Maxx, has also signaled that tariffs may weigh on revenues. Other retailers reporting this week include Lowe’s and Ross Stores, both of which may also offer insights into consumer strength amid inflation and trade-related headwinds.

Last Week’s Key Economic Data & News Recap

U.S. July Retail Sales Rise 0.5% MoM; Real Retail Sales Post 10th Consecutive Monthly Increase

July retail sales data showed broad-based improvement in consumer activity. Nominal retail sales rose by 0.5% MoM, slightly below expectations of 0.6%, but June’s figure was revised up from 0.6% to 0.9%. Excluding auto sales, July sales rose by 0.3%, in line with forecasts.

Since retail sales are reported in nominal terms, real (inflation-adjusted) retail sales provide a clearer picture of consumer purchasing power. Real retail sales rose 1.2% YoY in July, marking the 10th consecutive month of positive growth, indicating that consumer spending continues to expand despite inflation pressures.

U.S. July PPI Surges 0.9% MoM, Highest in Three Years; Rises 3.3% YoY

According to data released last Thursday by the U.S. Bureau of Labor Statistics, the Producer Price Index (PPI) rose 3.3% YoY in July, up sharply from 2.3% in June and well above the forecast of 2.5%, marking the highest level since February.

Monthly PPI jumped 0.9%, the largest gain since June 2022 (forecast: 0.2%; previous: 0.0%).

Core PPI (excluding food and energy) rose 3.7% YoY, the highest since February (forecast: 3.0%; previous: 2.6%), while the monthly core PPI also surged 0.9%, the biggest increase since April 2022 (forecast: 0.2%; previous: 0.0%).

U.S. Tariff Revenues Hit Record High in July, But Trump-Era Budget Deficit Widens Further

U.S. tariff revenues hit a record high in July, yet the increase was not enough to prevent a wider monthly budget deficit, highlighting ongoing fiscal challenges.

According to data released last Tuesday by the U.S. Treasury Department, customs tariff revenues reached $28 billion in July, up 273% YoY. However, after adjusting for calendar effects, the monthly budget deficit still reached $291 billion, a 10% increase from a year earlier.

As the current fiscal year approaches its end in September, the U.S. is heading toward another large annual budget deficit. As of July FY2025, the 10-month cumulative deficit reached $1.63 trillion. After calendar adjustments and excluding deferred tax receipts from FY2024, the deficit narrowed by 4% YoY.

Treasury Secretary Bessent previously projected tariff revenues may reach $300 billion for FY2025, with potential for further increases in 2026. However, most economists believe structural pressures, including interest payments on public debt and entitlement spending, remain the key challenges to U.S. fiscal sustainability.

U.S. July CPI Rises 2.7% YoY, Below Expectations; Core CPI Posts Highest Gain Since February

U.S. July CPI data suggests inflation pressure remains moderate, and the market’s concerns about a surge in inflation due to tariffs have not materialized. CPI rose 0.2% MoM, in line with forecasts. YoY CPI came in at 2.7%, slightly below expectations of 2.8%. Core CPI, however, rose to its highest level since February, driven mainly by rising services prices.

Despite the slight rebound in core inflation, the overall mild CPI data eased a major hurdle for the Federal Reserve to proceed with rate cuts.

U.S. Jobless Claims Edge Down, Continued Claims Remain at Highest Since 2021

Last week’s jobless claims data showed a slight decline, suggesting that while companies are slowing hiring, large-scale layoffs are not occurring.

According to data released Thursday by the U.S. Department of Labor, initial jobless claims for the week ending August 9 fell by 3,000 to 224,000, matching levels last seen in November 2021, and coming in lower than expectations (225,000) and the previous figure (226,000).

While economic uncertainty due to Trump’s tariff policies has led companies to reduce hiring efforts, the low initial claims indicate no significant rise in layoffs.

Investing with an AimStar's investment professional

Want expert advice at every step of your investing journey?

AimStar’s investment professionals can set you on the right course – and they can meet in-person or online.

Last Week’s Market Performance Recap

Source: Yahoo Finance

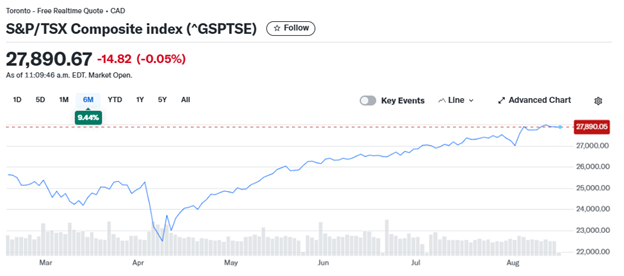

Canadian Equities:

The S&P/TSX Composite Index closed last week at 27,905 points, posting a 0.5% weekly gain — its second consecutive weekly increase. The index has now risen nearly 13% year-to-date.

Source: Yahoo Finance

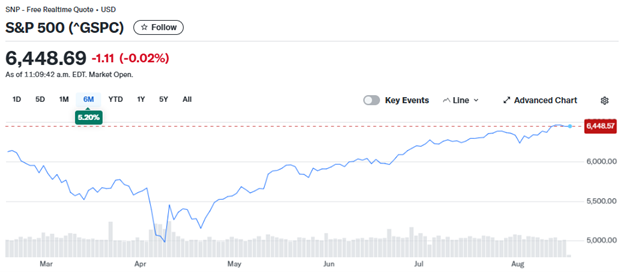

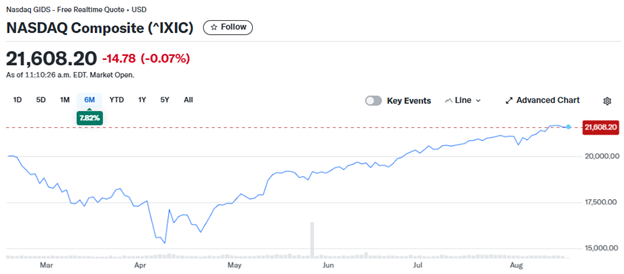

U.S. Equities:

U.S. stocks ended last week with solid gains across all three major indexes, reflecting investor confidence despite mixed economic signals. July retail sales met market expectations, though consumer confidence declined and inflation expectations rose. The Dow Jones Industrial Average closed at 44,946.12, posting a 1.75% weekly gain; the S&P 500 ended at 6,449.80, up 0.93%; and the Nasdaq Composite finished at 21,622.98, gaining 0.79% for the week.

Source: Yahoo Finance

U.S. Bonds:

Last week, the U.S. 10-year Treasury yield closed at 4.32%, rising by approximately 4 basis points for the week, marking its second consecutive weekly increase. In contrast, the 2-year Treasury yield ended at 3.75%, down by about 1 basis point over the same period.

Source: Yahoo Finance

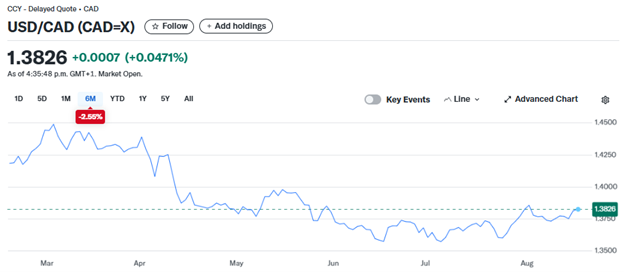

Forex Market:

The U.S. Dollar Index closed just below 97.90, posting a weekly decline of over 0.3%. After the release of retail sales data, the dollar trimmed some of its losses. However, following weaker consumer confidence data, the dollar extended its decline, hitting a more than two-week low.

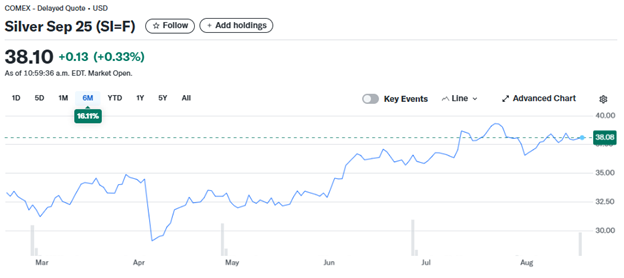

Source: Yahoo Finance

Gold Market:

Spot gold settled near $3,339.10, recording a weekly loss of over 1.7% — its biggest weekly decline since the week of June 27.

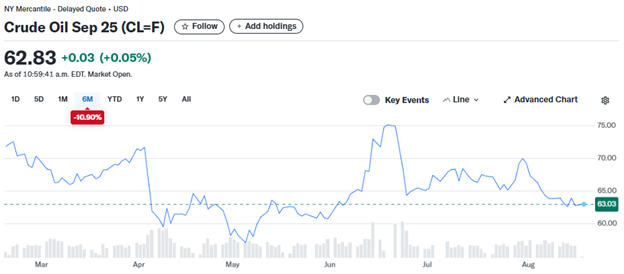

Source: Yahoo Finance

Oil Market:

U.S. crude (WTI) and Brent crude both hovered near their lowest closing levels since June 2 and June 5, respectively, as reached last Wednesday.

WTI September crude futures settled at $62.80 per barrel, down 1.69% for the week, while Brent October futures closed at $65.85 per barrel, posting a weekly decline of 1.11%.

- Let us contact you

Investing with an AimStar's investment professional

Want expert advice at every step of your investing journey?

AimStar’s investment professionals can set you on the right course – and they can meet in-person or online.

Financial Market Data Copyright © 2025 AimStar myportfolio. Data as of August 18, 2025, 12:30 PM EST

WHAT'S HAPPENING THIS WEEK

August 18 (Monday)

- Economic Data & Events: NAHB Housing Market Index (August)

- Key Earnings: Palo Alto Networks (PANW)

August 19 (Tuesday)

- Economic Data & Events: Housing Starts (July)

- Key Earnings: Home Depot, Medtronic (MDT), Keysight Technologies (KEYS), Viking Holdings (VIK), XPeng (XPEV), Toll Brothers (TOL)

August 20 (Wednesday)

- Economic Data & Events: FOMC July Meeting Minutes; Fed Speaker – Atlanta Fed President Raphael Bostic

- Key Earnings: TJX Companies, Lowe’s, Analog Devices (ADI), Target, Estée Lauder (EL), Baidu (BIDU)

August 21 (Thursday)

- Economic Data & Events: Existing Home Sales (July); Initial Jobless Claims (week ending August 16); Philadelphia Fed Manufacturing Index (August); S&P Global U.S. Flash PMI (August); U.S. Leading Economic Indicators (July);Fed Speaker – Atlanta Fed President Raphael Bostic; Jackson Hole Economic Policy Symposium begins

- Key Earnings: Walmart, Intuit (INTU), Workday (WDAY), Ross Stores

August 22 (Friday)

- Economic Data & Events: Fed Chair Jerome Powell’s speech at the Jackson Hole Symposium

Author by: Mark Ma

Edited & Published by: Sarah San

August 18 , 2025 13:00 AM EST. 10 min read

AimStar Capital Group Inc. is a Canadian full-service Investment Dealer, regulated by Canadian Investment Regulatory Organization (CIRO) and a member of Canadian Investor Protection Fund (CIPF). As an independent firm, AimStar is built on a foundation of innovation, integrity, and client-centricity. They are committed to providing unbiased advice and dedicated to the client’s needs, helping them achieve their financial goals.

AimStar is recognized as a Wealth Professionals 5-star Wealth Management Firm for 2024, this award recognized AimStar has offered exceptional client experience, a proven investment track record, continuous innovation, and stringent regulatory compliance.