Key Focus This Week “Inflation Data Imminent, Major Earnings Set to Dominate Market Attention”

Fewer companies are reporting earnings this week compared with earlier in the season, shifting market attention to two key U.S. economic releases: the July Consumer Price Index (CPI) and Producer Price Index (PPI). Both are important indicators for the Federal Reserve’s interest rate outlook. If inflation continues to ease, expectations for rate cuts could strengthen; if the data comes in above forecasts, the case for keeping rates higher for longer may gain traction.

On the trade front, the United States and China have agreed to extend their trade truce by 90 days, easing near-term concerns over escalating tensions. The move is viewed as supportive for global supply chain stability, especially for technology and manufacturing sectors with heavy exposure to the Chinese market. However, the extension simply allows negotiations to continue and does not resolve underlying differences, meaning that any setbacks could quickly lead to renewed market volatility.

In monetary policy, the Reserve Bank of Australia’s upcoming interest rate decision is expected to influence the Australian dollar, commodity prices, and investor sentiment across Asia-Pacific markets. Investors are also awaiting the release of the Bank of Canada’s meeting minutes for further policy insights.

On the corporate earnings calendar, notable companies this week include Applied Materials, JD.com, Sina, Oklo, and BigBear.ai. Semiconductor and technology firms’ results not only reflect sector health but are also shaped by global trade and monetary policy trends. Applied Materials continues to post strong revenue growth, supported by robust demand for its flagship Sym3 Magnum system used in advanced manufacturing processes. Many market participants expect its latest results to offer valuable signals on demand trends in the semiconductor manufacturing industry.

Key Economic Data & News Review – Last Week

Early August Sees Strong Earnings from Global Industry Leaders as Technology, Consumer, and Healthcare Sectors Rally

In early August 2025, multiple major companies delivered strong earnings results. Palantir, boosted by AI adoption and government contracts, posted Q2 revenue of $1billion, up 48 % year over year, with its share price hitting an all-time high. AMD reported revenue of $7.7 billion, a 32% increase from the prior year. Uber recorded $12.65 billion in revenue and $1.36 billion in net income, alongside a $20 billion share repurchase plan. McDonald’s revenue rose 5% year over year to $6.84 billion, while Disney reported $23.56 billion in revenue, up 2.1%. Novo Nordisk saw first-half net sales grow 16%, driven by strong performance of its weight-loss drug Wegovy. Eli Lilly, fueled by demand for its weight-loss and diabetes treatments, posted $15.56 billion in revenue, with sales of its weight-loss drugs surging 172%. Overall, the technology, consumer, and healthcare sectors delivered robust growth.

Sharp Decline in Imported Consumer Goods Narrows U.S. Trade Deficit

According to data released by the U.S. Department of Commerce’s Bureau of Economic Analysis on August 5, the U.S. overall trade deficit in June narrowed to $60.20 billion, down 16%. The U.S. trade deficit with China has cumulatively decreased by $22.2 billion, representing a 70% decline.

U.S. Labor Productivity Rebounds in Q2, Easing Wage Inflation Pressures

According to data released by the U.S. Bureau of Labor Statistics on August 7, nonfarm labor productivity in the second quarter of 2025 rebounded as the economy recovered, with a preliminary reading of 2.4%. Nonfarm unit labor costs rose 1.6%. Developments in artificial intelligence contributed to productivity gains, and as technology upgrades improved worker efficiency, wage inflation pressures were partially alleviated.

Initial Jobless Claims in the U.S. Hit Recent High

Data released by the U.S. Department of Labor on August 7 showed that, for the week ending August 2, seasonally adjusted initial claims for unemployment benefits stood at 226,000, up 7,000 from the previous week and marking the highest level in four weeks. A slower pace of labor supply, partly influenced by immigration policies, along with modest job growth, suggests the unemployment rate may remain stable.

U.S. Consumer Credit Growth Accelerates in June

Data released on August 7 showed that U.S. total consumer credit rose by $7.37 billion in June, compared with a $5.1 billion increase in May, marking a noticeable acceleration. Consumer credit maintained a steady annual growth rate of 1.8% in June.

Federal Reserve Officials Cautious on Rate Cut Prospects

On August 4, San Francisco Federal Reserve President Mary Daly addressed the prospect of interest rate cuts, noting that unemployment indicators suggest the U.S. labor market is softer than it was a year ago. Citing signs of inflation recovery alongside a rebound in employment, Daly cautioned that multiple rate cuts could be warranted, with the timing contingent on further evidence of inflation’s return. On August 5, Atlanta Federal Reserve President Raphael Bostic stated that he is in no rush to adjust rates, highlighting the need for a deeper assessment of how tariff policies may affect the broader economy. Against a backdrop of macroeconomic uncertainty, Federal Reserve officials continue to adopt a cautious stance toward rate reductions.

Investing with an AimStar's investment professional

Want expert advice at every step of your investing journey?

AimStar’s investment professionals can set you on the right course – and they can meet in-person or online.

Market Performance Review – Last Week

Source: Yahoo Finance

Canadian Equities:

Following the sharp decline during the long “Civic Holiday” weekend, the Canadian stock market rebounded strongly. The rally was primarily driven by optimism over the possibility of a U.S. Federal Reserve rate cut in September, along with rising commodity prices, which boosted energy and technology stocks. This uplift in share prices improved market sentiment, encouraged investors, and attracted additional capital inflows.

The S&P/TSX Composite Index surged nearly 2.73% to close at 27,761 on August 7, marking its highest close, before experiencing mild fluctuations and a pullback on August 8 to close at 27,759, leaving the index relatively stable.

Source: Yahoo Finance

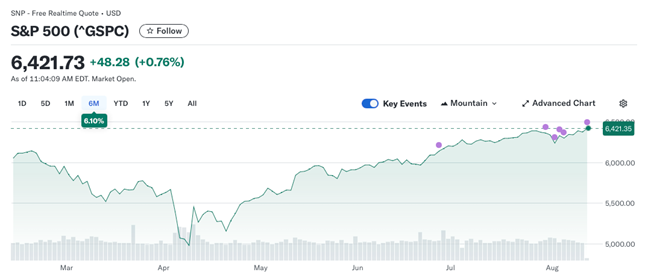

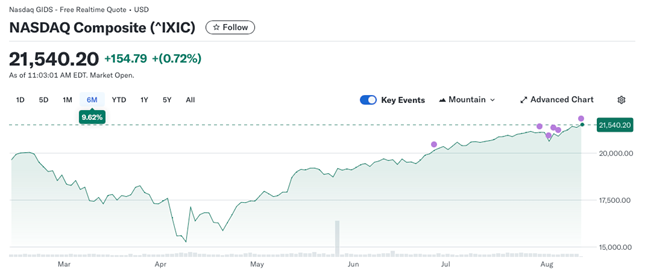

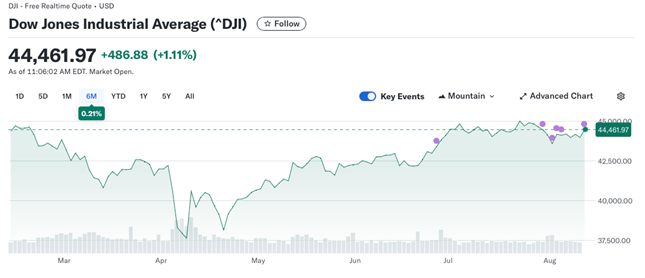

U.S. Equities:

Last week, U.S. equities experienced a volatile trading period, with all three major indexes ending the week with notable losses. However, the market has since staged a strong rebound, offsetting the sharp drop seen during the “Civic Holiday” period and showing an upward trend.

Investor attention remains focused on the Federal Reserve’s interest rate policy. The sharp decline in non-farm payroll growth last week to 73,000 has fueled expectations that the Fed may maintain low interest rates or even cut rates in the future. This sentiment, along with sector-wide gains, particularly in technology, has helped drive the rally.

The strength is reflected across the three major indexes: the Nasdaq Composite rose 3.87%, the S&P 500 gained 2.43% for the week, and the Dow Jones Industrial Average advanced 1.35%.

Source: Yahoo Finance

U.S. Bonds:

Last week, the yield on the U.S. 10-year benchmark Treasury rose to 4.29, marking a weekly gain of 1.54%. The two-year Treasury yield closed at 3.76%, up 1.51% for the week.

Source: Yahoo Finance

Forex Market:

The U.S. Dollar Index ended last week at 98.18, down 0.52% from Monday’s close of 98.69. The Canadian dollar strengthened modestly, rising 0.9% to 1.39 per U.S. dollar from 1.37 at the start of the week.

Source: Yahoo Finance

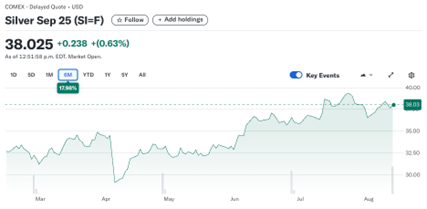

Gold Market:

Spot gold closed at $3,439.1 per ounce, up 1.92% for the week. The slight decline in last week’s U.S. Dollar Index (DXY) made dollar-denominated gold more attractive to buyers using non-U.S. currencies, as they could purchase it at relatively lower prices. At the same time, expectations of a Federal Reserve rate cut, along with the sharp swings in U.S. equities, prompted more investors to turn to gold for hedging and safe-haven purposes.

Source: Yahoo Finance

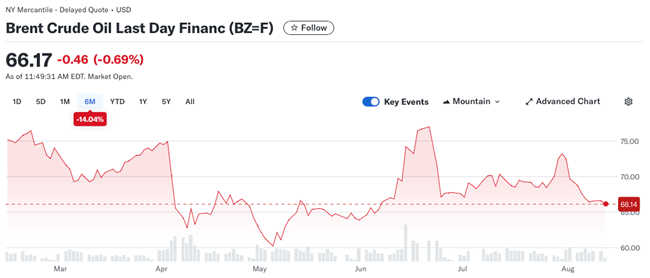

Oil Market:

WTI September crude oil futures settled at $66.59 per barrel, down 4.42% for the week.

- Let us contact you

Investing with an AimStar's investment professional

Want expert advice at every step of your investing journey?

AimStar’s investment professionals can set you on the right course – and they can meet in-person or online.

Financial Market Data Copyright © 2025 AimStar myportfolio. Data as of August 11, 2025, 12:30 PM EST

WHAT'S HAPPENING THIS WEEK

August 11 (Monday)

- Economic Data & Events: NAB Business Confidence Index (Australia), Intel CEO visit to the White House

- Key Earnings: Oklo, BigBear.ai

August 12 (Tuesday)

- Economic Data & Events:S. July Consumer Price Index (CPI), Reserve Bank of Australia (RBA) interest rate decision, S&P Global Investment Manager Index (August)

- Key Earnings: CoreWeave, Circle

August 13 (Wednesday)

- Economic Data & Events: Bank of Canada meeting minutes release

August 14 (Thursday)

- Economic Data & Events:S. July Producer Price Index (PPI), China July Housing Price Index, Industrial Production, Retail Sales of Consumer Goods, Unemployment Rate, and other key data

- Key Earnings: Applied Materials (AMAT)

August 15 (Friday)

- Economic Data & Events: China July Unemployment Rate, U.S. July Retail Sales, August University of Michigan Consumer Sentiment Index

Author by: Mark Ma

Edited & Published by: Sarah San

August 11 , 2025 13:00 AM EST. 10 min read

AimStar Capital Group Inc. is a Canadian full-service Investment Dealer, regulated by Canadian Investment Regulatory Organization (CIRO) and a member of Canadian Investor Protection Fund (CIPF). As an independent firm, AimStar is built on a foundation of innovation, integrity, and client-centricity. They are committed to providing unbiased advice and dedicated to the client’s needs, helping them achieve their financial goals.

AimStar is recognized as a Wealth Professionals 5-star Wealth Management Firm for 2024, this award recognized AimStar has offered exceptional client experience, a proven investment track record, continuous innovation, and stringent regulatory compliance.