Key Focus This Week “Central Bank Decisions and Mega-Cap Earnings Set the Tone for Markets”

Markets enter the week with attention centered primarily on U.S. monetary policy and peak earnings season, while Canadian investors also monitor domestic policy developments for signals on the interest rate outlook. Following last week’s consolidation across major equity indices, upcoming central bank decisions and large-cap earnings releases are expected to play a key role in shaping near-term market sentiment..

In the United States, the main focus will be the Federal Reserve’s interest rate decision and related communications. Investors will closely analyze the policy statement and Chair Powell’s press conference for guidance on the timing and pace of potential rate adjustments, particularly as recent economic data continue to point toward moderating inflation and slowing but stable growth. Interest rate expectations remain a central driver across U.S. equities, bonds, and currency markets.

In Canada, attention will also turn to the Bank of Canada’s interest rate decision. While global markets are largely driven by U.S. policy signals, the BoC’s assessment of domestic inflation and economic conditions will be closely watched for implications on Canadian financial conditions, the Canadian dollar, and interest rate–sensitive sectors within the domestic equity market.

Earnings season further intensifies during the week, with several large-cap companies across technology, financial services, and industrial sectors scheduled to report. Given elevated valuations in select segments of the market, investor reactions are expected to be driven less by headline earnings results and more by forward guidance, particularly management commentary on revenue growth, margins, and capital expenditure plans. Mega-cap U.S. technology earnings are likely to remain especially influential due to their significant weighting in major equity indices.

Beyond central bank decisions and earnings releases, investors will monitor key U.S. economic indicators, including durable goods orders, consumer confidence, and inflation-related data, for insights of broader macroeconomic trends.

Last Week’s Key Economic Data & News Recap

U.S. Equity Markets: Consolidation After Recent Gains

U.S. equity markets traded within a relatively narrow range during the shortened trading week, as investors digested early earnings releases while remaining cautious ahead of upcoming macro and policy events. The Dow Jones Industrial Average exhibited mixed daily movements, with gains and losses largely driven by stock-specific developments rather than broad market momentum.

With markets closed on Monday for Martin Luther King Jr. Day, trading activity was compressed into the latter part of the week. Despite intermittent rallies, equity indices struggled to establish a clear directional trend, reflecting restrained risk appetite following strong performance earlier in the month.

Monetary Policy

Expectations: Interest Rate Sensitivity Remains Elevated

Expectations surrounding the Federal Reserve continued to play a central role in shaping market behavior. Although no policy decision occurred during the week, investor positioning reflected heightened sensitivity to interest rate expectations ahead of the upcoming Federal Open Market Committee meeting.

U.S. Treasury yields fluctuated within a limited range, indicating that markets were recalibrating expectations for the pace and timing of potential rate cuts rather than pricing in a clear shift in policy stance. This uncertainty contributed to uneven performance across rate-sensitive sectors, as investors adjusted exposure amid an evolving policy outlook.

Earnings Season: Forward Guidance Takes Precedence

The early phase of earnings season began to influence equity performance, though its impact remained more pronounced at the individual stock level than at the index level. While several companies reported results broadly in line with expectations, market reactions were increasingly driven by management commentary on future growth rather than by headline earnings figures alone.

Investor focus centered on the sustainability of revenue growth, the ability of firms to maintain margins amid ongoing cost pressures, and the outlook for capital spending and investment priorities. In several instances, companies delivering solid near-term results nonetheless experienced share-price declines, reflecting cautious investor interpretation of forward guidance and longer-term growth visibility.

Technology Sector: Cautious Positioning Ahead of Mega-Cap Earnings

Large-cap technology stocks traded with limited conviction during the week, as investors positioned ahead of upcoming earnings releases from major platform companies. Given the sector’s outsized influence on major equity indices and its sensitivity to interest rate expectations, trading activity reflected a defensive posture rather than aggressive risk-taking.

Valuation considerations and uncertainty surrounding forward guidance contributed to subdued performance, with investors awaiting clearer signals on revenue growth trajectories, artificial intelligence investment trends, and cost management discipline.

Investing with an AimStar's investment professional

Want expert advice at every step of your investing journey?

AimStar’s investment professionals can set you on the right course – and they can meet in-person or online.

Last Week’s Market Performance Recap

Source: Yahoo Finance

Canadian Equities:

The S&P/TSX Composite Index closed at 33,144.98, gaining 0.43% on Friday, continuing to trade near recent highs following a steady upward trend over the past several months.

Source: Yahoo Finance

Source: Yahoo Finance

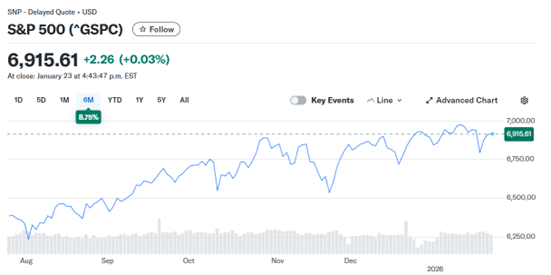

U.S. Equities:

The S&P 500 ended the week at 6,915.61, posting a marginal 0.03% increase, indicating largely range-bound trading amid earnings releases and interest rate uncertainty. The Nasdaq Composite rose 0.28% to 23,501.24, supported by relative resilience in growth-oriented and technology stocks. The Dow Jones Industrial Average declined 0.58% to 49,098.71, underperforming broader indices as industrial and value-oriented components weakened.

Source: Yahoo Finance

U.S. Bonds:

The U.S. 10-year Treasury yield closed at 4.239%, edging lower on Friday as bond markets remained stable ahead of upcoming monetary policy signals.

Source: Yahoo Finance

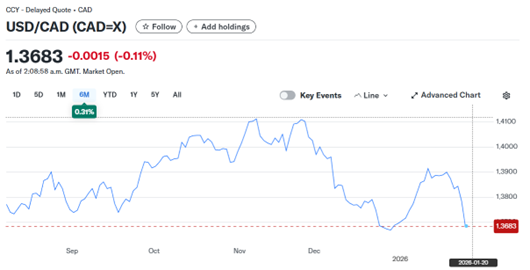

Forex Market:

The USD/CAD exchange rate closed at 1.3784, reflecting modest U.S. dollar strength supported by interest rate differentials.

Source: Yahoo Finance

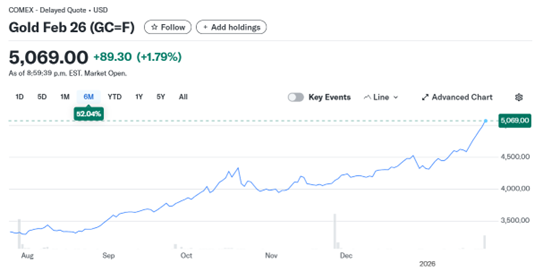

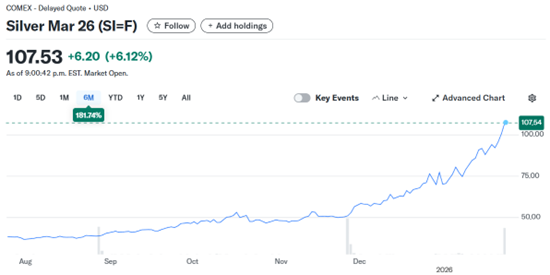

Gold Market:

Gold settled at 4,976.2, remaining elevated as demand for defensive assets persisted amid macro uncertainty. Silver closed at 100.925, broadly tracking movements in gold during the week.

Source: Yahoo Finance

Oil Market:

Crude oil prices closed at $61.07 per barrel, reflecting subdued price action as supply and demand expectations remained balanced.

- Let us contact you

Investing with an AimStar's investment professional

Want expert advice at every step of your investing journey?

AimStar’s investment professionals can set you on the right course – and they can meet in-person or online.

26Financial Market Data Copyright © 2026 AimStar myportfolio. Data as of January 26, 2026, 12:30 PM EST6

WHAT'S HAPPENING THIS WEEK

January 26 (Monday)

• Economic Data & Events: U.S. Durable-Goods Orders (Dec).

• Key Earnings: Ryanair, Baker Hughes, Steel Dynamics, AGNC Investment, Nucor, Crane.

January 27 (Tuesday)

• Economic Data & Events: U.S. President Trump Speaks, Canada Whole Sales (Dec), U. S. Consumer confidence (Jan).

• Key Earnings: UnitedHealth, Boeing, UPS, General Motors, RTX, Texas Instruments, Seagate.

January 28 (Wednesday)

• Economic Data & Events: FOMC interest-rate decision, Fed Chair Powell press conference, U.S. President Trump Speaks, U. S. Crude Oil Inventories, Canada BoC Interest Rate Decisions

• Key Earnings: ASML, ADP, Microsoft, Meta, Tesla, IBM, Lam Research, ServiceNow.

January 29 (Thursday)

• Economic Data & Events: U.S. Initial Jobless Claim.

• Key Earnings: Mastercard, Caterpillar, Nasdaq, Blackstone, Apple, Visa, SAP, Western Digital.

January 30 (Friday)

• Economic Data & Events: Core PPI (Dec), PPI year over year, Core PPI year over year

• Key Earnings: American Express, Verizon, Chevron, Exxon Mobil, Charter Communications, LyondellBasell, Air Products, Autoliv, SoFi.

Author by: Sarah San

Edited & Published by: Sarah San

January 26, 2026, 12:30 PM EST. 10 min read

AimStar Capital Group Inc. is a Canadian full-service Investment Dealer, regulated by Canadian Investment Regulatory Organization (CIRO) and a member of Canadian Investor Protection Fund (CIPF). As an independent firm, AimStar is built on a foundation of innovation, integrity, and client-centricity. They are committed to providing unbiased advice and dedicated to the client’s needs, helping them achieve their financial goals.

AimStar is recognized as a Wealth Professionals 5-star Wealth Management Firm for 2024, this award recognized AimStar has offered exceptional client experience, a proven investment track record, continuous innovation, and stringent regulatory compliance.