Key Focus This Week “Earnings momentum, key macro data, and policy-related events shape a shortened trading week”

Markets enter the week of January 19 following mixed global performance, with U.S. equity and bond markets closed on Monday for Martin Luther King Jr. Day, compressing the trading week to four sessions. Tighter liquidity conditions may heighten market sensitivity to incremental information and short-term volatility.

The fourth-quarter earnings season remains the primary driver, with companies across major sectors reporting results. Netflix and Intel will be closely watched for signals on consumer demand, capital spending, and broader industry trends. In a relatively stable policy environment, earnings outcomes and guidance are expected to continue driving sector rotation and stock-specific dispersion.

Macro attention will focus on U.S. third-quarter GDP (final) and the PCE price index, which will help refine the inflation outlook following last week’s CPI release. From a policy perspective, remarks by U.S. President Donald Trump on housing-related issues may temporarily elevate market sensitivity, particularly across housing-linked sectors.

Last Week’s Key Economic Data & News Recap

U.S. Equity Markets Pulled Back After Early-Week Record Highs

U.S. equity markets ended the week modestly lower after advancing to record levels earlier in the period. Major indices moved higher at the start of the week, supported by momentum from the prior week, before retreating as investors digested inflation data and the first round of fourth-quarter earnings releases. Daily market coverage during the week showed a pattern of early gains followed by late-session pullbacks, indicating a moderation in risk-taking after recent highs.

Sector performance reflected this shift in tone. Cyclical sectors that had led gains earlier showed signs of consolidation, while market leadership narrowed as investors reassessed valuations following the recent rally.

Inflation Data Pointed to Stable Price Trends

Inflation data released mid-week showed continued moderation in price pressures. The Consumer Price Index (CPI) for December increased 0.3% month-over-month, while the year-over-year rate remained unchanged at 2.7%, matching November’s reading. Core CPI, which excludes food and energy, rose 0.2% month-over-month and held steady at 2.6% year-over-year.

Compared with prior months, the data suggested that inflation trends remained stable rather than accelerating, reinforcing expectations that monetary policy would remain unchanged in the near term. Market reaction to the CPI release was measured, with limited follow-through in equities and bond yields following the announcement.

Earnings Season Began with Mixed Market Reactions

The start of fourth-quarter earnings season featured results from several large U.S. financial institutions. Reported earnings generally showed improved profitability compared with the same period last year, reflecting stronger trading activity and a gradual recovery in investment banking revenues. Despite these results, share prices of several major banks declined following their earnings releases.

Market reaction indicated that investors were focused less on headline earnings and more on revenue composition, forward guidance, and policy-related considerations. In particular, discussions around regulatory and political developments affecting the banking sector appeared to weigh on sentiment, contributing to financial stocks underperforming the broader market during the week.

Precious Metals Extended Gains as Cross-Asset Volatility Persisted

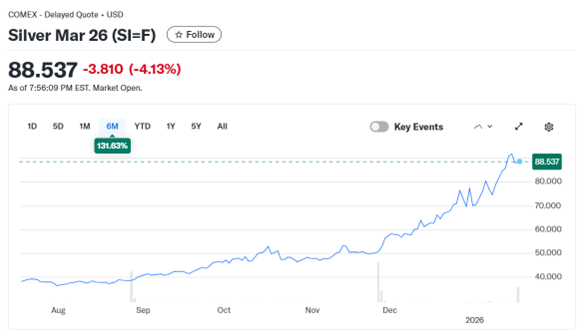

Precious metals remained a notable area of strength during the week. Silver prices stayed near recent highs, extending gains accumulated earlier in 2026 after a sharp rally from late-2025 levels. Compared with year-end pricing, silver has posted substantial year-to-date increases, reflecting sustained demand amid volatile equity market conditions.

Gold prices also remained elevated over the week, holding onto recent gains as investors maintained exposure to defensive assets. The continued strength in precious metals contrasted with choppier performance in equities, highlighting ongoing cross-asset dispersion as markets balanced inflation data, earnings developments, and broader macro uncertainty.

Investing with an AimStar's investment professional

Want expert advice at every step of your investing journey?

AimStar’s investment professionals can set you on the right course – and they can meet in-person or online.

Last Week’s Market Performance Recap

Source: Yahoo Finance

Canadian Equities:

Canadian equities were relatively stable over the week. The S&P/TSX Composite Index closed at 33,040.55 on Friday, up 0.04% on the day. On a week-over-week basis, the index finished modestly higher, supported by strength in resource-linked sectors, while broader market performance remained rangebound.

Source: Yahoo Finance

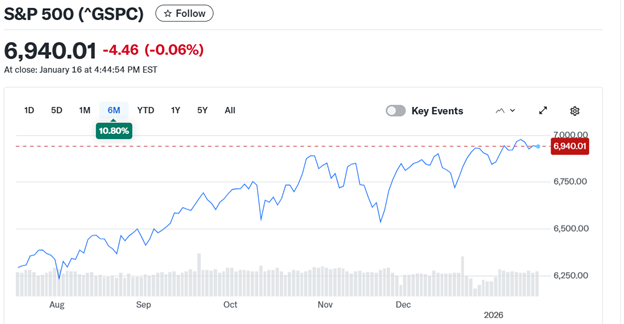

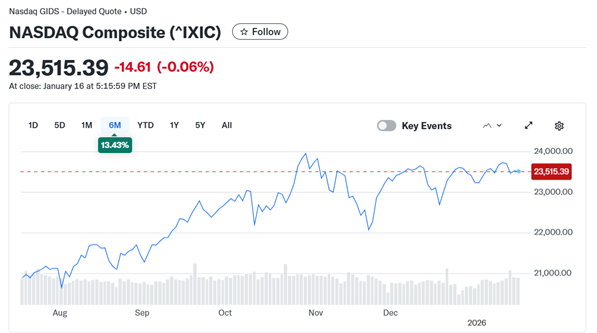

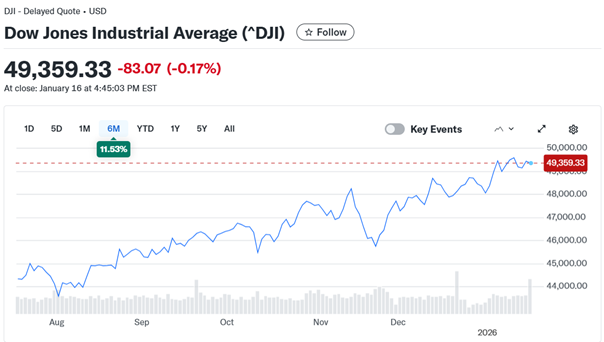

U.S. Equities:

U.S. equity markets ended the week slightly lower after reaching record levels earlier in the period. The Dow Jones Industrial Average closed at 49,359.33 on Friday, down 0.17% on the day and modestly lower on a week-over-week basis, reflecting consolidation after recent gains. The S&P 500 finished at 6,940.01, down 0.06% on Friday, while the Nasdaq Composite closed at 23,515.39, edging lower by 0.06%. Compared with the prior week, all three major indices showed limited net movement, indicating a pause in upward momentum following early-week highs.

Source: Yahoo Finance

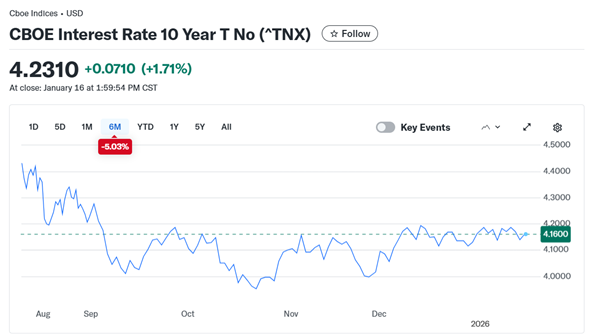

U.S. Bonds:

The 10-year U.S. Treasury yield rose to approximately 4.23% by Friday, increasing from earlier-week levels following the release of inflation data.

Source: Yahoo Finance

Forex Market:

In currency markets, the USD/CAD exchange rate closed near 1.3893, down 0.12% on the day. Over the course of the week, the pair remained within a relatively narrow range.

Source: Yahoo Finance

Gold Market:

Gold prices finished at $4,595.40, down 0.61% on the day, though prices remained elevated compared with late-2025 levels. Silver closed at $88.54, declining 4.13% on Friday, following sharp gains earlier in the year. Despite the pullback, silver remained significantly higher on a multi-month basis.

Source: Yahoo Finance

Oil Market:

Crude oil prices closed at $59.34 per barrel, up 0.44% on Friday, ending the week slightly higher after a volatile trading period.

- Let us contact you

Investing with an AimStar's investment professional

Want expert advice at every step of your investing journey?

AimStar’s investment professionals can set you on the right course – and they can meet in-person or online.

26Financial Market Data Copyright © 2026 AimStar myportfolio. Data as of January 19, 2026, 12:30 PM EST6

WHAT'S HAPPENING THIS WEEK

January 19 (Monday)

- Economic Data & Events: EUR CPI (Dec), Canada CPI (Dec)

January 20 (Tuesday)

- Key Earnings: 3M, United Airlines, Netflix

January 21 (Wednesday)

- Economic Data & Events: U.S. President Trump Speaks.

- Key Earnings: Johnson & Johnson, Halliburton, Kinder Morgan, Ally Financial, Charles Schwab, Travelers

January 22 (Thursday)

- Economic Data & Events: U.S. Q3 GDP (First Revision), U.S. PCE Index (Nov).

- Key Earnings: Procter & Gamble, Intel, Capital One, CSX, GE Aerospace

January 23 (Friday)

- Economic Data & Events: U.S. Manufacturing PMI, U.S. Service PMI

- Key Earning: Schlumberger, Ericsson, Comerica, First Citizens BancShares

Author by: Sarah San

Edited & Published by: Sarah San

January 19, 2026, 12:30 PM EST. 10 min read

AimStar Capital Group Inc. is a Canadian full-service Investment Dealer, regulated by Canadian Investment Regulatory Organization (CIRO) and a member of Canadian Investor Protection Fund (CIPF). As an independent firm, AimStar is built on a foundation of innovation, integrity, and client-centricity. They are committed to providing unbiased advice and dedicated to the client’s needs, helping them achieve their financial goals.

AimStar is recognized as a Wealth Professionals 5-star Wealth Management Firm for 2024, this award recognized AimStar has offered exceptional client experience, a proven investment track record, continuous innovation, and stringent regulatory compliance.