Key Focus This Week “ U.S. Earnings Season Heats Up, Led by Tesla and Google; Housing Data and Fed Commentary Also in Spotlight”

Corporate earnings will take center stage this week. A number of major U.S. companies are set to release quarterly results, including Tesla, Alphabet (Google’s parent company), Intel, Verizon, Coca-Cola, General Motors (GM), and HCA Healthcare. Tesla’s report is expected to draw particular attention, as investors closely watch the performance of its core auto business, developments in its newly launched robotaxi, and CEO Elon Musk’s increasingly high-profile political remarks. Alphabet’s earnings may offer more insight into its AI strategy, while Intel, amid layoffs and restructuring, is expected to provide updates on its contract chip manufacturing ambitions.

Beyond the tech and industrial sectors, this week’s earnings also cover consumer, healthcare, and energy names. Coca-Cola and General Motors may shed light on how tariffs are impacting U.S. business operations. Verizon and AT&T are scheduled to report as well, with markets watching for signs of subscriber growth. HCA Healthcare will report on Friday, with its recent data breach posing a potential risk investors will be watching.

On the macroeconomic front, June’s existing and new home sales data will offer insight into the ongoing struggles of the U.S. housing market. While existing home sales ticked up slightly in May, the annualized sales pace remains near historic lows. High mortgage rates, elevated home prices, and tight inventory continue to weigh on demand. New home sales data, due Thursday, may show relative strength amid improving inventory levels.

In addition, Thursday will bring initial jobless claims and June durable goods orders, which will provide further clues on the labor market and manufacturing activity. On Tuesday, Fed Chair Jerome Powell and Governor Michelle Bowman are scheduled to speak at a Fed banking conference. As this falls within the pre-meeting blackout period, they are unlikely to comment directly on interest rate policy. Also speaking at the event is OpenAI CEO Sam Altman, whose remarks may offer insights into the future of AI technology and regulation.

Last Week’s Key Economic Data & News Recap

U.S. Inflation Rises Again in June as Tariff Effects Begin to Emerge

According to data from the U.S. Bureau of Labor Statistics, the U.S. Consumer Price Index (CPI) rose 2.7% year-over-year in June, in line with expectations. The CPI increased 0.3% month-over-month in June, also matching forecasts. The predictions from 75 analysts ranged from a 0.1% to a 0.4% increase. Excluding food and energy, core CPI rose 0.2% month-over-month, compared to an expected 0.3%. Core inflation in the U.S. recorded a smaller-than-expected increase for the fifth consecutive month in June, mainly dragged down by vehicle prices. Data released by the Bureau of Labor Statistics on Tuesday showed that excluding the volatile food and energy components, the CPI rose 0.2% from May and 2.9% year-over-year. For products heavily reliant on foreign supply chains, inflation accelerated in June.

U.S. Initial Jobless Claims Fall for Fifth Straight Week

The U.S. Department of Labor reported that initial jobless claims fell by 7,000 last week to 221,000, better than the forecast of 233,000. This marks the fifth consecutive week of decline. The forecast range from 43 surveyed economists was between 220,000 and 240,000. The four-week moving average of initial claims was 229,500. For the week ending July 5, continuing jobless claims increased by 2,000 to 1.956 million.

U.S. Retail Sales Exceed Expectations in June, Signs of Slowing Consumer Spending Emerge

U.S. retail sales rose 0.6% in June from the previous month, beating the expected 0.1%. Excluding autos, retail sales increased 0.5%, above the forecast of 0.3%. Total retail sales in June reached $720.1 billion. Retail sales excluding auto dealers, building materials, and gas stations rose 0.5% month-over-month. The stronger-than-expected rebound may reflect price increases in some tariff-affected goods. Overall, while the household sector still provides support, consumer spending appears to be slowing.

U.S. Housing Starts Unexpectedly Rise in June, But Single-Family Construction Hits 11-Month Low

Official U.S. economic data released last Friday showed that single-family housing starts fell to an 11-month low in June, as high mortgage rates and economic uncertainty continued to suppress homebuying, signaling another decline in residential investment for Q2. Specifically, U.S. housing starts rose to an annualized rate of 1.321 million units in June, exceeding expectations. According to the U.S. Census Bureau, the annualized rate of housing starts rose from 1.263 million in May to 1.321 million in June. The average forecast from 53 economists was 1.3 million units, with estimates ranging from 1.181 million to 1.35 million.

U.S. Consumer Sentiment Hits Five-Month High in Early July as Inflation Expectations Improve

U.S. consumer sentiment rose to a five-month high in early July as expectations for the economy and inflation continued to improve. According to preliminary data released last Friday by the University of Michigan, the July consumer sentiment index rose from 60.7 in June to 61.8. However, the level remains below most readings throughout last year. Consumers now expect a 4.4% inflation rate over the next year, down from 5% in the previous month and the lowest since February. They expect inflation to average 3.6% over the next 5–10 years, the lowest in five months.

U.S. PPI Flat in June, Below All Estimates

U.S. producer prices were unchanged in June, as falling service costs offset other increases, indicating that businesses are absorbing at least part of the cost pressures stemming from higher import tariffs. According to a report released last Wednesday by the U.S. Bureau of Labor Statistics, the Producer Price Index (PPI) was flat from May, which was revised up to a 0.3% increase. The median forecast of economists surveyed was a 0.2% increase. Excluding food, energy, and trade, core PPI was also unchanged month-over-month. Compared to the same period last year, the PPI rose 2.5%, the smallest increase since the end of 2023.

U.S. PPI data for June came in unexpectedly weak, thanks to falling prices in the service sector — a sign that companies are at least partially absorbing the costs caused by higher import tariffs.

Investing with an AimStar's investment professional

Want expert advice at every step of your investing journey?

AimStar’s investment professionals can set you on the right course – and they can meet in-person or online.

TRENDS IN INDICES

Source: Yahoo Finance

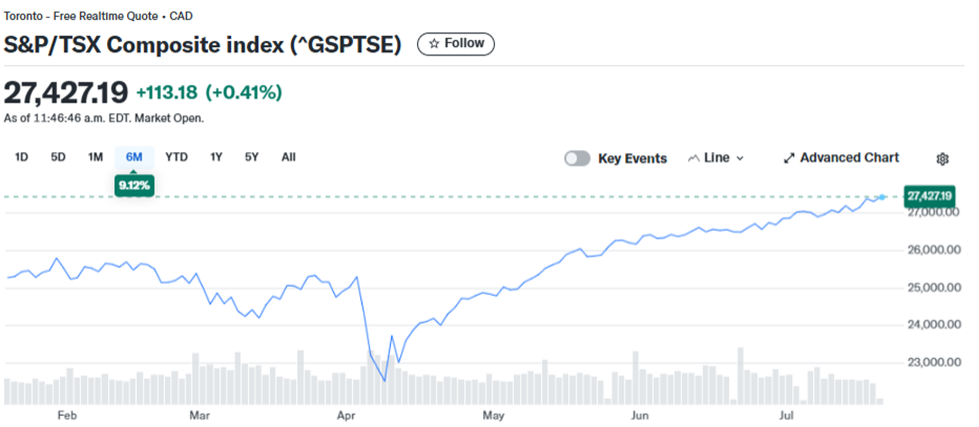

Canadian Equities:

The S&P/TSX Composite Index ended last week at 27,314 points, posting a weekly gain of over 1%, supported by strong U.S. economic data and rising expectations of near-term interest rate cuts by the Federal Reserve.

Source: Yahoo Finance

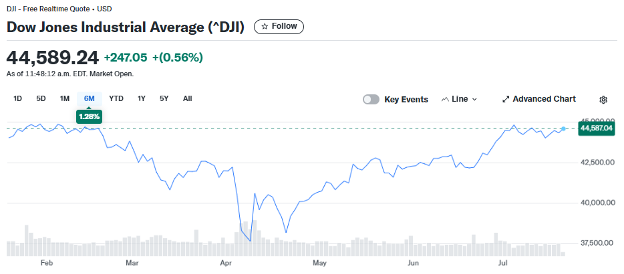

U.S. Equities:

Last week, U.S. stocks ended mixed, with the Nasdaq rising for a fifth consecutive session and hitting both intraday and closing record highs. The Dow Jones Industrial Average slipped 0.07% for the week, while the Nasdaq gained 1.51% and the S&P 500 rose 0.59%.

Markets experienced some volatility amid rumors that former President Trump plans to fire Federal Reserve Chair Jerome Powell if re-elected. However, strong economic data and growing optimism around corporate earnings helped support equities, offsetting uncertainty fueled by Trump’s tariff rhetoric.According to FactSet, of the 59 S&P 500 companies that have reported so far, over 86% have exceeded earnings expectations.

At Friday’s close, the S&P 500 settled at 6,296.79, the Dow Jones Industrial Average at 44,342.19, and the Nasdaq at 20,895.66.

Source: Yahoo Finance

U.S. Bonds:

Last week, the U.S. 10-year Treasury yield closed at 4.42%, down 3.58 basis points for the week. The 2-year Treasury yield ended at 3.87%, declining 3.54 basis points over the same period.

Falling inflation expectations, combined with Federal Reserve Governor Christopher Waller signaling support for a rate cut in July, helped bolster demand for short-term Treasuries, putting downward pressure on yields.

Source: Yahoo Finance

Forex Market:

Last week, the U.S. Dollar Index rose to 98.52, marking a second consecutive week of gains. Federal funds futures traders are pricing in a total of 46 basis points of rate cuts by the end of the year, implying two 25-basis-point cuts, with the first expected in September.

The USD/JPY pair increased by 0.95% to 148.83 yen. Japan is scheduled to hold its upper house elections on Sunday, with the ruling party appearing vulnerable, which could trigger domestic policy uncertainty.

Meanwhile, former President Trump is pushing for any deal with the European Union to set a minimum tariff rate between 15% and 20%. The British pound remained flat at $1.341, with a weekly decline of 0.64%.

Source: Yahoo Finance

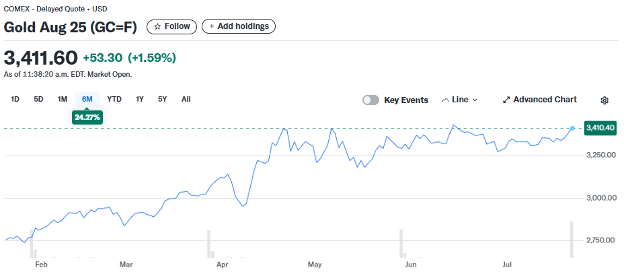

Gold Market:

Gold prices rose last Friday, supported by a weaker dollar and ongoing geopolitical and economic uncertainties that boosted demand for safe-haven assets. Gold closed at $3,351.75 per ounce, though it recorded a weekly decline of 0.12%.

Spot silver was priced at $38.1975 per ounce, down 0.51% for the week.

Source: Yahoo Finance

Oil Market:

Last week, oil futures were mostly unchanged on Friday, as mixed news on the U.S. economy and tariffs balanced concerns over supply following the European Union’s latest sanctions on Russia due to the Ukraine war.

Brent crude futures closed at $69.28 per barrel, while U.S. crude futures settled at $67.34 per barrel. Both major benchmarks fell about 2% over the course of the week.

- Let us contact you

Investing with an AimStar's investment professional

Want expert advice at every step of your investing journey?

AimStar’s investment professionals can set you on the right course – and they can meet in-person or online.

Financial Market Data Copyright © 2025 AimStar myportfolio. Data as of July 21, 2025, 12:30 PM EST

WHAT'S HAPPENING THIS WEEK

July 21 (Monday)

- Economic Data & Events: U.S. Leading Economic Indicators for June.

- Key Earnings: Verizon, NXP Semiconductors, Roper Technologies, and Domino’s Pizza.

July 22 (Tuesday)

- Economic Data & Events: Federal Reserve Chair Powell and Governor Bowman will speak at a Fed banking conference.

- Key Earnings: SAP, Coca-Cola, Philip Morris, Texas Instruments, RTX Corp., Intuitive Surgical, Lockheed Martin, Sherwin-Williams, Capital One Financial, Northrop Grumman, and General Motors.

July 23 (Wednesday)

- Economic Data & Events: U.S. Existing Home Sales for June.

- Key Earnings: Alphabet, Tesla, IBM, T-Mobile US, ServiceNow, AT&T, Thermo Fisher Scientific, NextEra Energy, Boston Scientific, and GE Vernova.

July 24 (Thursday)

- Economic Data & Events: U.S. New Home Sales for June, Initial Jobless Claims for the week ending July 19, and preliminary July S&P US Manufacturing/Services PMI.

- Key Earnings: Honeywell International, Union Pacific, Blackstone, and Intel.

July 25 (Friday)

- Economic Data & Events: U.S. Durable Goods Orders for June.

- Key Earnings: HCA Healthcare, Aon, Charter Communications, Phillips 66, and Booz Allen Hamilton.

Author by: Mark Ma

Edited & Published by: Sarah San

July 21 , 2025 13:00 AM EST. 10 min read

AimStar Capital Group Inc. is a Canadian full-service Investment Dealer, regulated by Canadian Investment Regulatory Organization (CIRO) and a member of Canadian Investor Protection Fund (CIPF). As an independent firm, AimStar is built on a foundation of innovation, integrity, and client-centricity. They are committed to providing unbiased advice and dedicated to the client’s needs, helping them achieve their financial goals.

AimStar is recognized as a Wealth Professionals 5-star Wealth Management Firm for 2024, this award recognized AimStar has offered exceptional client experience, a proven investment track record, continuous innovation, and stringent regulatory compliance.